If you’re in the restaurant biz you’ll know how important it is to stay on top of your finances. With profit margins for Aussie restaurants averaging a razor thin 2%, knowing exactly how much money is coming in versus what’s going out is a fine balancing act.

Creating and maintaining a restaurant balance sheet is a great way to understand and map out your business’ finances, so you’re not left with any unwelcome surprises at the end of the year.

Before we dive into the ins and outs of a restaurant balance sheet, it’s important to touch on the significance of a profit and loss statement, and how this can be used in conjunction with your balance sheet to give a true representation of your restaurant’s finances.

In this post, we’ll cover:

- Profit and loss statement in a nutshell

- What is a restaurant balance sheet?

- How to create a restaurant balance sheet

- Restaurant balance sheet example

- A helping hand from tech

What does it take to run a successful business? (Webinar)

Hospitality veterans discuss how their venues are still going strong after 10 years in operation. The panel discuss day-to-day challenges, how to manage them, and the role technology plays to find new sources of revenue.

Profit and loss statement in a nutshell

A profit and loss (or P&L) statement tracks your restaurant’s revenue, cost of goods sold (COGs) and expenses over time to show if you’re operating at a loss or if you’re profitable.

To calculate your P&L statement, in any given period, use this simple formula:

Total sales – cost of goods sold – expenses = profit or loss

For example: let’s say you’re calculating your P&L for the month of November. Total sales for the month equal $87,000. COGS cost you $21,000 and your other expenses total $49,000. Your P&L formula would look like this:

87,000 – 21,000 – 49,000 = 17,000

Which means for the month of November you made a profit of $17,000.

To really drill down into your P&L statement it’s helpful to break down each section even further – such as expenses into labour costs, rent and utilities. This will allow you to understand which areas of the business are costing the most and what needs to be optimised.

Understanding your restaurant’s financial performance with a P&L statement is important when it comes to optimising your restaurants operating expenses, but it doesn’t always tell the whole story. That’s where your restaurant balance sheet comes in.

What is a restaurant balance sheet?

A restaurant balance sheet provides an overarching view of the financial health of your restaurant. By listing your assets, liabilities (debt) and equities at a given point in time, you’re presented with a snapshot of your restaurant’s net worth. Not only does this give you an understanding of your current financial situation, it also lets you plan your short and long term cash flow.

Think of your balance sheet as a set of scales – with your assets on one side and liabilities on the other. The aim of the balance sheet is to understand where you’re sitting on the scale – are you losing money, turning a profit or breaking even?

How to create a restaurant balance sheet

To create your restaurant balance sheet you’ll need to list out three main categories:

- Assets: this refers to anything and everything your restaurant owns, such as cooking equipment, cash on hand, furniture and inventory.

- Liabilities: this needs to detail exactly what your restaurant owes, like loans, outstanding bills or your property lease.

- Equity: think of this as your retained earnings or net assets. You can only work this out once you’ve outlined your total assets and total liabilities. Essentially your equity is what’s left over after you subtract your liabilities from your assets.

Assets

Your assets should fall under two subcategories when creating your restaurant balance sheet; current assets and fixed assets.

Current assets, also known as liquid assets, can be converted into cash quite easily. Your current assets would include things like cash on hand, current liquor inventory, funds in your bank account and stock on hand.

Fixed assets include any items that have been purchased for long term use and can’t easily be turned into cash. This would include things like furniture, kitchen equipment and any land or property you may own.

Liabilities

Like assets, your liabilities will also fall under two subcategories; current liabilities and long term liabilities.

Current liabilities refers to any external financial obligations that your restaurant is committed to within a certain period of time. This can include wages, building rent, loans and tax payments.

Long term liabilities aren’t that common in restaurants as they refer to long term financial obligations like capital leases, long term rent agreements or deferred income tax. However, if your restaurant has any of these liabilities, be sure to list them within this subcategory on your balance sheet.

Equity

Once you have tallied your assets and liabilities and then subtracted your total liabilities from your total assets, you’re left with equity. This number gives an up-to-date representation of your restaurants earnings or losses.

Profit and Loss Template

Examine the financial health of your business by highlighting exactly how much revenue is being generated versus what’s being spent.

Restaurant Balance Sheet Example

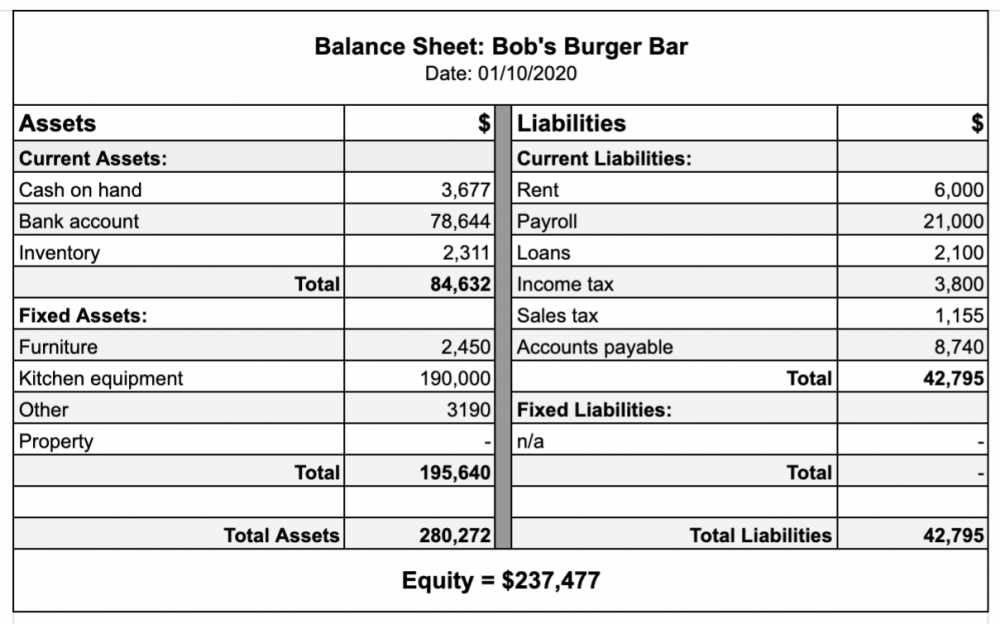

The example below shows the restaurant balance sheet for Bob’s Burger Bar up until October 1st 2020. All of the restaurant’s assets are listed in the left column and all liabilities in the right column, along with their respective totals.

A helping hand from tech

The thought of crunching all of these numbers manually is enough to give anyone a headache. Luckily, most modern POS systems, like Lightspeed, have powerful in-built reporting tools that can quickly drill down into your numbers so you can access detailed and easy to read reports.

POS systems are connected at every point of your business – from inventory to sales – and can integrate with accounting packages like MYOB, Xero and Quickbooks or employee software like Deputy. This means you can easily pull reports for specific time periods (day, week, month, year etc) on your COGS, sales, stock on hand, accounts payable, labour costs.. the list goes on.

While a POS system can’t populate your whole P&L statement or restaurant balance sheet, it can make life a lot easier by giving you quick and easy access to the key figures you’ll need.

2024 Report: Hospitality Insights and Dining Dynamics

A survey of Australian hospitality operators and consumers reveals in-depth insights on dining trends, the financial shifts in Australia, restaurant technology and what to watch in 2024.

Setting aside the time to create a restaurant balance sheet and P&L statement is the best way to stay on top of your finances and spot any trends that might be occurring. Having an overarching view of your restaurant’s financial health lets you optimise your operating costs and forecast for the future. While it might seem like a lengthy process, once you’ve got your templates set up, updating them (with a little help from POS reports) should be relatively hassle free.

See how Lightspeed could work for your restaurant, talk to one of our experts today.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.