Get fast, reliable funding with Lightspeed Capital

Our cash advance program is the easiest way to grow your business now.

Use Lightspeed Capital for any business purpose.

Plus, there's no strict payback schedule—you pay nothing until you make sales.

- Transparent pricing with no rising interest rates–just a flat fee

- No scheduled monthly payments

- The balance, including a flat fee, is remitted through a portion of your sales

- Capital can be requested again after your balance is remitted

Get funds in as soon as two business days.

There’s no lengthy application or credit check—so you can get to the funds sooner rather than later.

- Cash advance is deposited directly into your bank account

- Credit scores are unaffected by the process

- Flat-fee pricing structure with no hidden costs

- Eligibility is determined by business performance

Local businesses are the backbone of our communities, and Lightspeed’s goal is to make owning a successful independent business easier than ever. We believe real-time access to capital is one of the largest challenges facing independent merchants today. This expansion of Lightspeed Capital provides a simple, streamlined opportunity for our merchants to invest in their business. Our goal is to help turbocharge their operations ... all through a single, integrated commerce solution.

Jona Georgiou, Lightspeed's GM of Payments and Financial Services

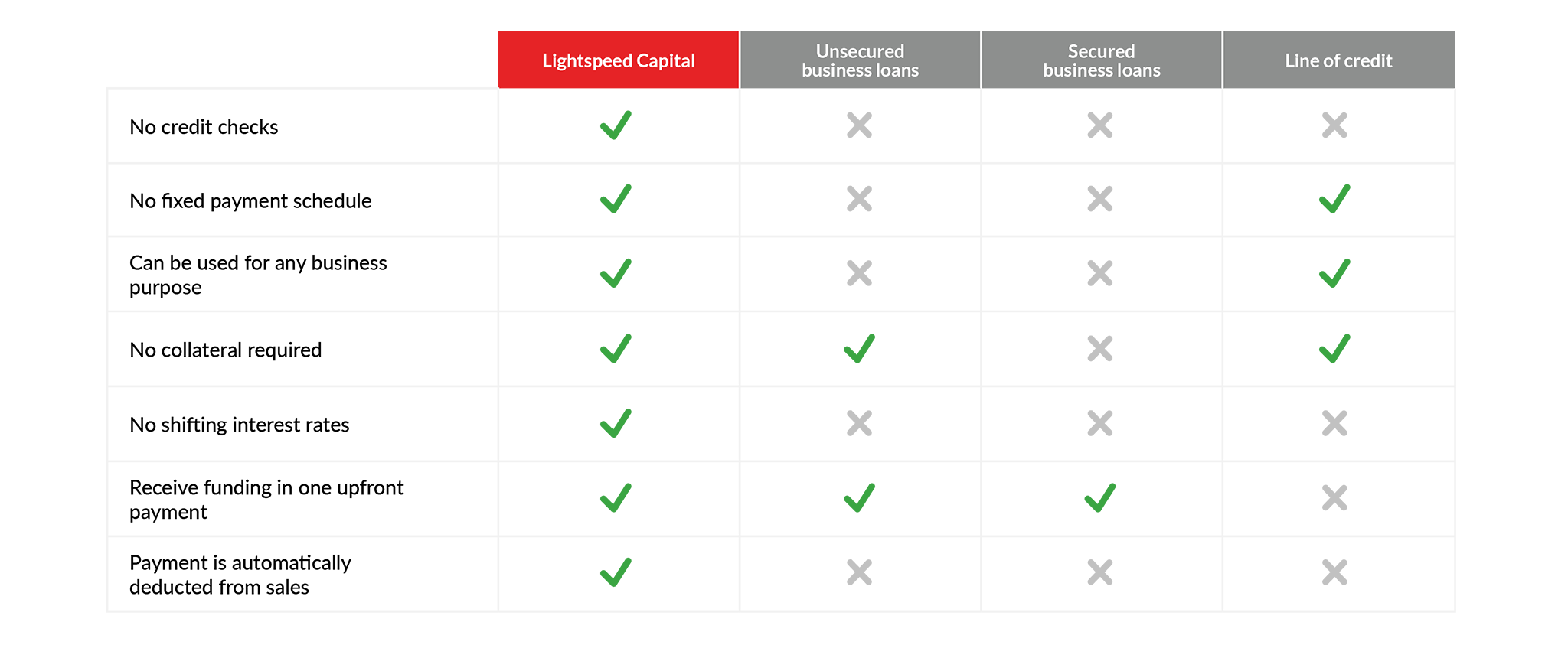

How does Lightspeed Capital compare to other types of funding?