Invoices are a crucial, perhaps mundane, part of running a business. Whether you’re running your first store, or you’re operating multiple stores, understanding the ins and outs of invoices is an integral skill all savvy merchants need to wield.

- What is an invoice?

- What’s the difference between an invoice and a bill?

- What’s the difference between an invoice and a purchase order?

- What are the different types of invoices?

- What do you include on an invoice?

- How do you make an invoice?

- 9 invoice best practices to follow

- 7 common invoice challenges

- How to analyse your invoices

What is an invoice?

An invoice is a commercial document that contains information about goods or services that have been provided by retailers to customers.

Invoices are used as a request for payment for the goods or services provided. It also serves as a record of the transaction for both the customer and the retailer. In many cases, an invoice will include payment terms, such as the due date for payment and any penalties for late payment.

What’s the difference between an invoice and a bill?

The terms “invoice” and “bill” can be used interchangeably, but there is a subtle difference between the two. An invoice is typically issued by a seller to a buyer to request payment for goods or services provided.

A bill, on the other hand, is usually a request for payment that is issued by a service provider, such as a utility company, to a customer. It typically includes information such as the account number, the amount owed, and the due date for payment. A bill is often a standardised form that is used for recurring payments, such as monthly utility bills.

What’s the difference between an invoice and a purchase order?

An invoice and a purchase order are two distinct documents that are used in different stages of a business transaction.

A purchase order is a document issued by a buyer to a seller that outlines the details of the goods or services that the buyer wants to purchase. It includes information such as the type and quantity of the goods or services, the price, any applicable discounts, and the delivery date. The purchase order serves as a formal offer to buy the goods or services and becomes a legally binding agreement once accepted by the seller.

An invoice, on the other hand, is a document issued by a seller to a buyer that requests payment for goods or services that have already been provided.

What are the different types of invoices?

There are several types of invoices a merchant may use:

- Recurring invoice: An invoice that is issued regularly, such as monthly or annually, for ongoing services or subscriptions.

- Pro forma invoice: An invoice that is issued to provide an estimate or quotation of the cost of goods or services, typically used for customs purposes.

- Timesheet invoice: An invoice that is issued based on the number of hours worked by an employee or contractor, typically used for hourly billing.

- Credit invoice: An invoice that is issued to correct an error or to provide a refund or credit to the buyer.

- Debit invoice: An invoice that is issued to request additional payment from the buyer, typically used to correct an underpayment or to charge additional fees.

- Commercial invoice: An invoice that is issued for the sale of goods, typically used for international shipments and customs purposes.

- Interim invoice: An invoice that is issued during a project or service delivery to request partial payment for work completed to date.

- Past due invoice: An invoice that is issued when payment is overdue, typically includes additional fees or penalties for late payment.

- Retainer invoice: An invoice that is issued to request payment for a retainer fee, typically used for professional services or legal representation.

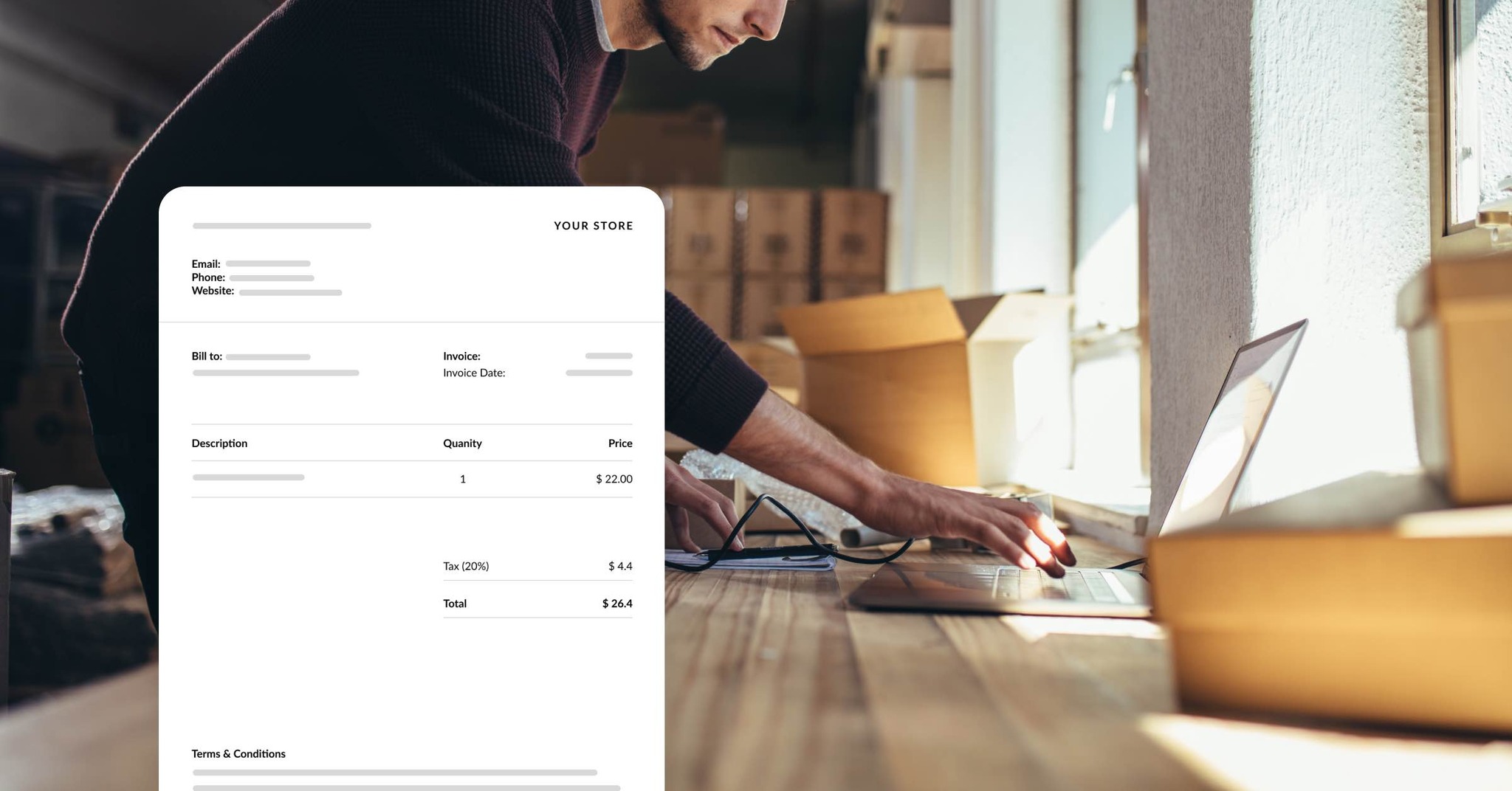

What do you include on an invoice?

An invoice typically includes the following information:

- Invoice header: This includes the word “invoice” and a unique invoice number to help identify and track the invoice.

- Date: The date the invoice was issued.

- Seller information: The name, address, and contact information of the seller or service provider.

- Customer information: The name, address, and contact information of the buyer or recipient of the goods or services.

- Description of goods or services: A detailed description of the goods or services provided, including the quantity and unit price.

- Total amount due: The total amount owed by the buyer, including any taxes or discounts.

- Payment terms: The due date for payment and any penalties for late payment.

- Payment options: The accepted methods of payment, such as check, credit card, or bank transfer.

- Additional information: Any additional information relevant to the transaction, such as shipping or handling fees.

It’s important to ensure that all of the information on the invoice is accurate and complete, as any errors or omissions could cause delays in payment or disputes between the buyer and seller.

How do you make an invoice?

Here are some general steps for creating an invoice, both manually and using software:

- Collect the necessary information: Gather all of the relevant information needed for the invoice, including the seller’s and buyer’s contact information, the goods or services provided, the quantity and price, and any applicable taxes or discounts.

- Choose a format: Decide on the format for the invoice, such as a paper invoice, an email invoice, or a digital invoice.

- Create the invoice manually: If creating a manual invoice, use a spreadsheet or word processing program to format the invoice, including the necessary information.

- Use invoicing software: If using invoicing software, select a software tool and follow the prompts to input the necessary information and generate the invoice.

- Review and proofread: Carefully review the invoice for accuracy and completeness, and proofread for any errors.

- Send the invoice: Send the invoice to the buyer via mail, email, or electronic payment system, depending on the format chosen.

When using invoicing software, the process is usually automated and streamlined. Many software tools provide templates that you can customise to suit your needs. Some software tools also offer features such as automatic reminders, recurring invoicing, and online payment processing, which can help to simplify the invoicing process.

Overall, the steps for creating an invoice manually or using software are similar, with software tools offering more convenience and automation.

9 invoice best practices to follow

- Be clear and concise: Use simple language and clear formatting to make your invoice easy to understand.

- Include all necessary information: Ensure that your invoice includes all necessary information, including the seller and buyer information, the date, the invoice number, a description of goods or services provided, the price, and payment terms.

- Use a unique invoice number: Use a unique invoice number for each invoice you create to make it easy to track and reference.

- Set payment terms: Clearly state the payment terms, including the due date and any late payment penalties.

- Provide payment options: Provide multiple payment options, such as credit card, bank transfer, or PayPal, to make it easy for the buyer to pay.

- Send invoices promptly: Send invoices promptly after the goods or services have been provided to avoid delays in payment.

- Follow up on late payments: Send reminders and follow up on late payments to ensure timely payment.

- Keep accurate records: Keep accurate records of all invoices, payments, and outstanding balances to help with financial reporting and tax compliance.

- Use invoicing software: Use invoicing software to streamline the invoicing process and automate tasks such as recurring invoicing and payment reminders.

By following these best practices, you can help ensure that your invoicing process is efficient, accurate, and effective, which can help improve cash flow and financial management for your business.

7 common invoice challenges

- Late payments: Late payments can cause cash flow problems for businesses, as they may have to delay payments to their own suppliers or vendors. This can lead to increased interest charges and other financial penalties.

- Disputes: Disputes can arise if the buyer disputes the quality or quantity of goods or services provided, or if there is a disagreement over pricing or payment terms.

- Bad debt: Bad debt occurs when a buyer fails to pay an invoice and the debt becomes uncollectible. This can be a significant financial loss for businesses, especially if they rely on a few key clients for their revenue.

- Inaccurate or incomplete invoices: Inaccurate or incomplete invoices can cause delays in payment or lead to disputes, as the buyer may not have all the information needed to make a payment.

- Difficulty tracking invoices: If businesses do not have a good system in place for tracking invoices, they may miss payments or fail to follow up on overdue invoices, leading to lost revenue.

- Difficulty managing payment terms: Managing payment terms can be challenging, especially if businesses have many different clients with different payment schedules and terms.

- Payment fraud: Payment fraud can occur when criminals steal or spoof invoice information and trick businesses into making payments to the wrong account.

By being aware of these common invoice challenges, businesses can take steps to mitigate them and improve their invoicing process, such as implementing clear payment terms and policies, using invoicing software to track invoices, and following up on late payments promptly.

How to analyse your invoices

Retail merchants can analyse their invoices to gain valuable insights into their business operations and make informed decisions about forecasting demand and adjusting inventory levels. Here are some key steps in analysing invoices:

- Categorise expenses: Categorise expenses on invoices by type (e.g. cost of goods sold, shipping and handling, overhead) to get a clear picture of where money is being spent.

- Identify trends: Look for trends in purchasing patterns, such as seasonality, product popularity, or supplier performance, to inform forecasting and inventory management decisions.

- Monitor inventory levels: Monitor inventory levels regularly to ensure that stock levels are aligned with demand and avoid stock outs or overstocks.

- Adjust inventory based on demand: Use insights from invoice analysis to adjust inventory levels based on demand forecasts and ensure that popular items are always in stock.

- Identify cost-saving opportunities: Analyse invoices to identify cost-saving opportunities, such as negotiating better prices with suppliers or optimising shipping and handling costs.

- Use data analytics tools: Utilise data analytics tools to analyse invoice data more efficiently and gain deeper insights into purchasing patterns and trends.

By regularly analysing their invoices and using data-driven insights to inform decision-making, retail merchants can optimise their inventory levels, improve their cash flow, and enhance their overall business performance.

Innovate how you do business

Chances are you’re an ambitious retailer with a clear vision of growth for your business. By using Lightspeed you can increase efficiencies across channels, attract new customers and keep your staff happy. Watch this demo to learn more about Lightspeed’s fast, intuitive retail platform.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.