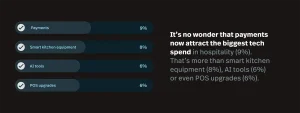

Hospitality operators across Australia are quietly rewriting the rulebook. This year, contactless payment terminals top the list of tech investments, drawing more budget than any other category.

This includes AI tools to POS systems in general.

According to Lightspeed’s Hospitality Insights & Dining Dynamics Report, 9% of venues’ annual tech budgets were allocated toward payment technology, making it the single largest investment area for 2025.

On paper, that might seem surprising. Payments? The part of the workflow that lives at the very end of a customer interaction? Traditionally seen as back-of-house admin?

But that’s exactly the point: payments are no longer an afterthought, and they shouldn’t be. They have the potential to become the beating heart of hospitality operations, providing a whole heap of data on efficiency, service and ultimately, guest satisfaction.

Let’s explore.

- A shift in perspective

- Time is the most valuable currency

- More than convenience

- Payment as a performance insight

- The final frontier

- The hidden dividend

- If payments are still an afterthought, you’re missing the point

Want to know what’s really changing in hospitality?

Lightspeed’s 2025 Hospitality Report reveals the shifts reshaping the guest experience. Explore the full report for free today.

A shift in perspective

Rewind to 2023. Most operators were looking to tech to cut costs. And that made sense after years of pandemic turbulence and the cautious budgeting these events inspired.

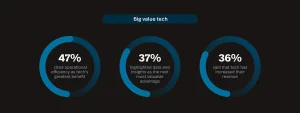

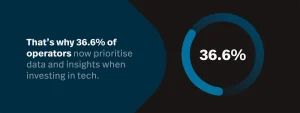

But in 2025, the tide has turned. Today’s operators are waking up to the potential that tech has in improving their bottom line. They no longer want these systems for the reduction in spend, but for the increase in output.

This evolution signals a more sophisticated understanding of tech ROI amongst hospitality operators. Efficiency and insights are now the battlegrounds—and integrated payments are helping operators win on both fronts.

And unlike other tools that may sit siloed or passive, payments can happen at every table, on every shift and for every bill. It’s a universal touchpoint which makes it one of the most powerful and untapped tools in an operator’s arsenal.

Time is the most valuable currency

When payments are embedded into a POS system, they speed up the transaction. But they also eliminate the disconnect between systems, reduce manual entry errors and cut down the time spent reconciling at close of day.

And all of these seconds add up fast.

According to Lightspeed’s data, venues using integrated payments save an average of 1h 46mins per day. For businesses operating six or seven days a week, that’s over 12 hours per week. More than 600 hours per year.

Venues using Tap to Pay via mobile terminals save an average of 1h 38mins per day. That’s time not spent waiting for static terminals to free up or manually splitting bills at the pass.

In an industry where margins are tight and labour is stretched, this reclaimed time is pure gold. It’s time back for prep, service or resetting—whatever the team needs most.

For busy venues, this could be the difference between staying afloat and pulling ahead.

Want to learn more about how the hospitality industry is using tech to guide their fortunes?

Our interactive experience lets you explore and engage with all of the data to create bespoke insights into what drives the industry forwards.

More than convenience

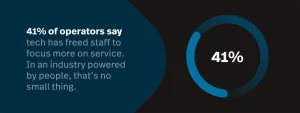

The rise of contactless payments is often framed as a guest convenience (which it absolutely is). But it’s just as much about relieving pressure on staff.

During service, contactless payments streamline the entire flow. There are fewer steps required to close out a table, which means less time spent circling back and forth with terminals or juggling paper dockets.

Staff aren’t stuck in queues at the register, waiting for a free EFTPOS terminal or entering manual totals. Instead, they can stay in motion because payments happen fast, on the floor and without interruption.

It’s no coincidence that:

Payment as a performance insight

Here’s where things get interesting.

Every transaction can act as its own data point. You’re capturing insights such as the time of purchase, the total spend, table size, payment method, tip amount and even an item-level breakdown of what was ordered.

All of this forms a live, real-time pulse of your venue. When properly analysed, it can reveal your peak trading hours, most popular dishes, preferred payment types, average table turnover times and patterns of guest loyalty.

You can quickly see that what starts as a payment becomes a powerful insight into how your business moves.

And all of it is fuel for smarter decisions.

They’re building a smarter tomorrow with payments that feed into performance dashboards and give them the ability to course-correct in real time.

That’s a level of agility most operators couldn’t dream of five years ago.

The final frontier

So, what has been the real game-changer in all of this?

The answer is embedded payments.

When your payments system is fully integrated with your POS, you start to unlock a wealth of benefits that ripple across your entire operation.

It means reconciliation happens automatically at the end of service, tips are tracked in real time, sales data syncs instantly between systems and reporting becomes cleaner and more accurate.

And perhaps most importantly, this kind of seamless integration creates a smoother, more consistent experience for both staff and guests.

The humble payments system. Once a silent outsider, is now front and centre in performance infrastructure.

The hidden dividend

It’s easy to get caught up in talking about insights and workflows. But the downstream effect of smarter payments is deeply human.

When venues save close to two hours per day thanks to integrated payments, that time gets reinvested back into the experience.

Staff can greet guests with genuine attention, not a rushed glance while juggling receipts. When problems arise, they have the headspace to handle them with real direction rather than urgency. Even short breaks between service waves become possible, helping teams stay sharp through the chaos of peak hours.

That kind of time is invaluable and immeasurable. It lifts moods, raises bars and feeds into a better atmosphere for both sides—staff and customers.

And the data backs this up.

Good tech restores the human touch that lets great hospitality shine.

If payments are still an afterthought, you’re missing the point

The clearest sign of progress is not a new feature or a new device—it’s a new mindset.

In the modern hospitality landscape, payment systems are performance platforms, insight engines and experience enhancers.

If your current payments setup doesn’t integrate with your POS, it’s likely holding your team back. And if it offers no visibility into how your guests prefer to pay, or when and how much they’re spending, then you’re missing out on valuable insights.

In these modern times, that’s a competitive disadvantage.

Every tap, swipe, or split bill tells a story about the transaction and about your business, allowing payments to shape the flow of service, unlock insights, reduce friction and—most importantly—give you back your time.

So next time you’re looking for the next tech investment to give you the edge over your competitors, it’s worth leading with payments.

Want your payments to take your business further?

With Lightspeed Payments, every transaction works harder to provide the valuable insights and flexibility to push your business forward.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.