“Scale & grow”: Rooster & Co. use Lightspeed POS & financial services products to power the business

Spearheaded by Nick & Sharifa Ghionis, a passionate husband and wife team, Rooster & Co. opened its doors during the Covid lockdowns. Three years later, the restaurant is a mainstay of the local community, and Nick & Sharifa are excited to grow Rooster & Co. further to become so much more than a local chicken shop.

Business type

Quick service restaurant

Customer since

2020

Locations

Melbourne

Rooster & Co. + Lightspeed

As a growing quick-service restaurant, Rooster & Co. needed a platform to scale with the business and streamline operations, from payments to sales, within one unified platform.

We spoke to Nick Ghionis, Founder and Owner of Rooster & Co., who walked us through his experience with Lightspeed.

At a glance

Lightspeed provides Rooster & Co. with a powerful POS and payments platform to seamlessly manage all aspects of the business and capital cash advances to reinvest into the business and foster growth.

- Enhance cash flow with flexible funding options

- Embedded payments ensure seamless transactions for shorter queues

- Easy-to-use system makes it easy to upsell

- In-depth reports allow for strategic decision-making

- Powerful platform empowers business growth

- Integrations make workflows more efficient

Enhance cash flow

“It’s incredible.”

Nick and Sharifa are driven entrepreneurs, and from the outset, they were keen to grow the success of Rooster & Co. However, as many other business owners will understand, having the cash flow to facilitate growth can sometimes be tricky.

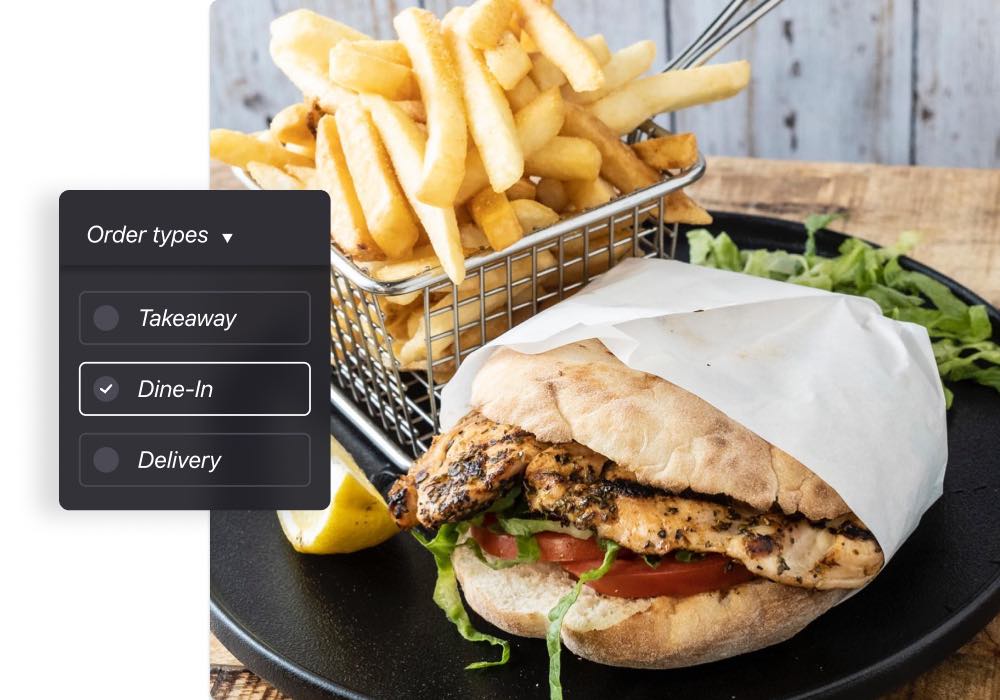

Thanks to Lightspeed Capital , Rooster & Co. were able to secure the funds they needed to reinvest back into the business. And, after an initial cash advance, the team at Rooster & Co. used Lightspeed Capital again to finance new projects and growth.

“As you grow in business, there are going to be cash flow issues at some point in time, and again, [Lightspeed Capital] just makes it so easy to do… It really helped me go through the motions, and I'm using it [Lightspeed Capital] again.”

Easy business investment

“It's been a little godsend.”

Nick and Sharifa also love how easy it was to secure a cash advance from Lightspeed, particularly compared to the long-winded process with many banks.

“When Lightspeed is responsible for [the cash advance]... they can see I'm taking a certain amount of money consistently for a very long period of time, so I don't have to prove to Lightspeed: Hey, I'm good. Trust me, I'm making this much money... I don't have to sit there and sell my firstborn just to get a small overdraft.”

Nick and Sharifa also analysed their historical sales data within Lightspeed to strategically forecast how much they could afford to take with Lightspeed Capital.

“Using the data collected from Lightspeed, you can go backwards and go okay; back in November and December, I had X amount of money coming in. This year, more. I'm already about 10% higher than last year. So you know what? I can probably afford to take X amount, which I did. It's a one-stop shop, so to speak.”

Seamless, embedded payments

“Haven’t looked back.”

When Nick and Sharifa were originally asked to move to Lightspeed Payments, they were hesitant.

“People do not like change… And to make a change, particularly when it comes to something as important as taking money from customers, that is scary as sh*t.”

However, after talking it through with their account manager, they were confident of the benefits for the business and started trading with Lightspeed Payments, and they haven’t looked back since.

“Once I made the change, it was like, what the hell? Why didn't I take that offer up earlier? After 2 or 3 days, it was just seamless. It was just fantastic. And I haven't looked back since.”

Quick, easy payments

“Very quick.”

Since adopting Lightspeed Payments, the team at Rooster & Co. have enjoyed how quick and easy the payment experience has been for both staff and customers. From the seamless connection between the POS and payment terminal to quickly taking orders over the phone, Nick & Sharifa have been impressed with the payment experience.

“It became seamless. And that kind of relationship between these devices and your software, it's a huge selling point... When it comes to using the new devices, even the ability to take phone orders is so easy.”

Another bonus? The money is in their account the next business day.

“It's very quick, and the money goes into your account in the next day or so.”

Quicker service

“Seamless.”

Another benefit of Lightspeed Payment for Rooster & Co. is the fact it helps them serve customers quicker during peak times.

“I use two POS systems… which meant that I was able to get two [payment] devices, which meant at a rush hour when you have someone who's at the counter umming and ahhing and looking at the menu… we can basically jump in [on the other terminal] and go, hey, what would you like?”

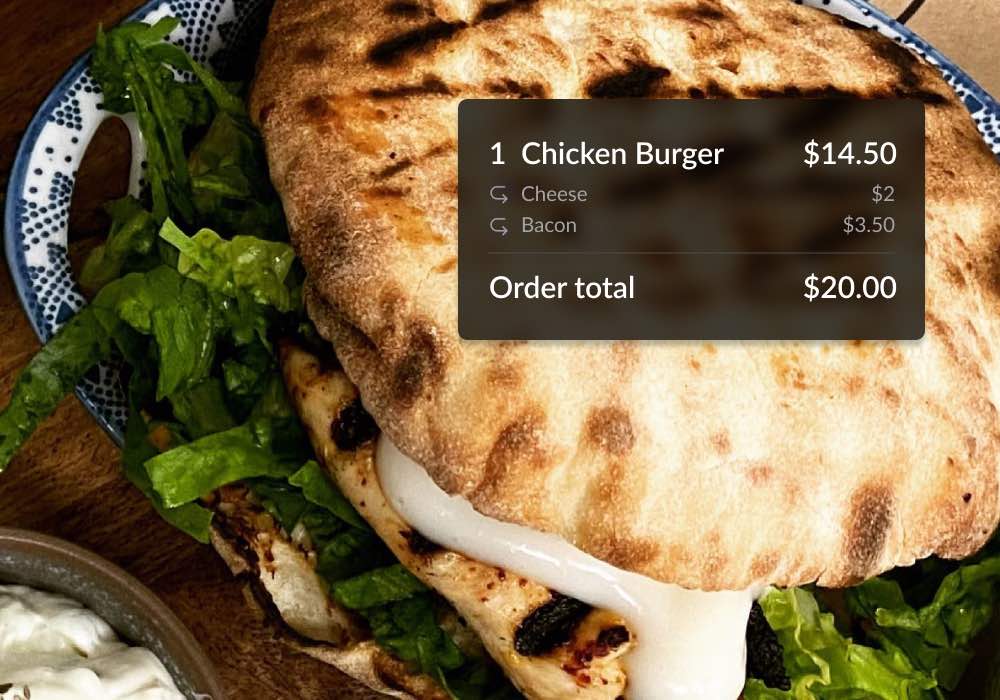

Easy upselling

“Intuitive.”

Like many quick-service restaurants, Rooster & Co. tend to employ casual staff who aren’t used to the world of hospitality, so things like upselling don’t always come naturally.

With Lightspeed, it’s easy for Nick and Sharifa to configure upselling prompts within the system, so staff never miss an opportunity to upsell.

“There's an opportunity to upsell, an opportunity to prompt the person taking the order to increase the sales of that particular item that someone actually sells.”

“Those upselling requirements through Lightspeed, which are a lot more intuitive, rather than me having to sit there trying to manually put things in. So I think that's been that's been really cool.”

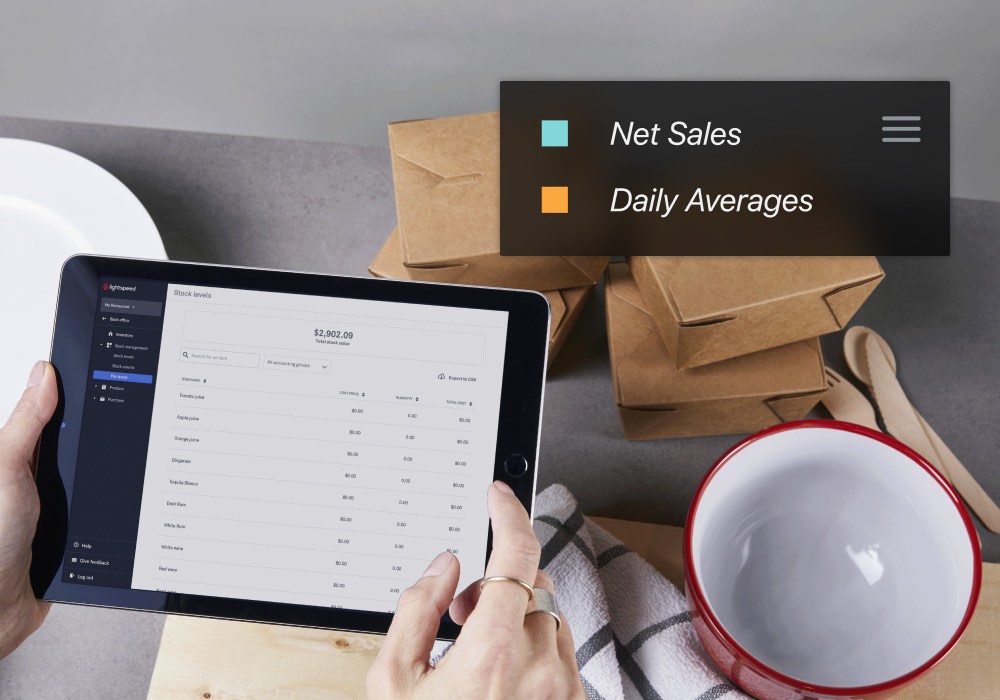

Strategic decision making

“So simple.”

As a business focussing on growth, Nick and Sharifa love how Lightspeed’s in-depth analytics tools empower them to make strategic decisions to improve business performance.

“There's a lot of reporting that helps me make decisions when it comes to rostering or looking at sales by hours.”

One of the great things about Lightspeed’s reports is that they contain a wealth of data in a simple, easy-to-digest format.

“For someone who is not very good at Excel spreadsheets, I think it's actually a really cool way of actually just making it so simple to be able to look at your data and make decisions accordingly.”

Menu planning

“I’ve got the data.”

Nick and Sharifa also use Lightspeed’s analytics tools to understand what menu items are working and which are underperforming to consistently optimise their menu.

“Whenever I'm designing a new menu… I've got the data in front of me to suggest, this is what you sell. This is what you don't sell much of... Why am I giving so much real estate on my menu board for something that's not necessarily selling?”

“I'm going through the whole new menu board at the moment based on the last 12 months of what's going, what's not going, what is good, what isn't good about our menu board, using the data from Lightspeed. That actually helps me achieve that.”

Powerful platform

“Grow and scale.”

Nick and Sharifa are passionate about growing Rooster & Co., and when they were first looking for a powerful POS platform, one of the key things they wanted was a system that could grow and scale with them.

“Whenever we do anything, we don't just look at what we're going to do now. We think, okay, where are we going? What can we do? Or how are we going to scale this business in the future? Are we going to open up more stores?”

With this growth mindset, Nick and Sharifa believed Lightspeed was the perfect fit for their business. However, they acknowledge that they still haven’t fully delved into everything Lightspeed has to offer.

“Whilst Lightspeed has been amazing, I know that I'm probably using about 10 - 15% of it... And that's the key with many of these software programs that are great is that they're so good that, unfortunately, many of us don't necessarily take the full gamut of it all.”

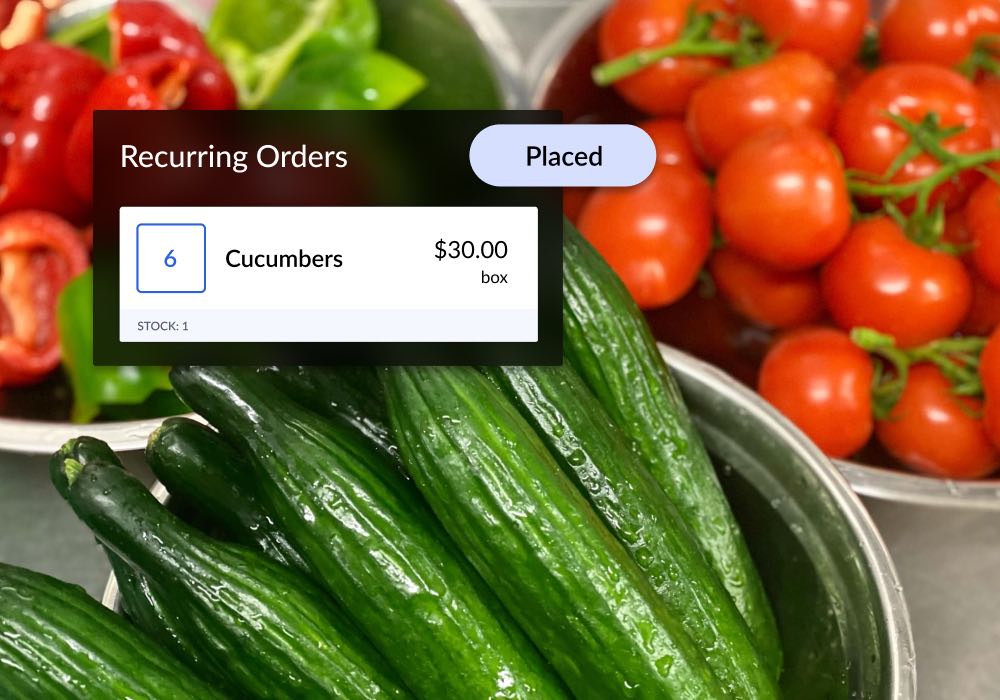

Integrations boost efficiency

“Integral.”

Another thing Nick and Sharifa love about Lightspeed is that the platform integrates with so many other systems, making operating more efficient.

“We're very reliant on subscriptions and software that help us to either scale or to at least do the work more efficiently and a lot more profitable... So when it came to our business here, it was one of those things where I found that Lightspeed became an integral part of our journey.”

For example, integrating with Deliverect meant they could automatically sync all of their delivery orders to one tablet, rather than having multiple to manage or manually enter orders into the POS.

“Integrating with Deliverect was amazing because having all these tablets all over the place when it comes to all these online portals became a nuisance.”

Reduce double handling

“Amazing.”

Lightspeed integration with Bopple also allows Rooster & Co. to accept orders online. And, as the two platforms are seamlessly integrated, the team doesn’t have to worry about double-handling menus or orders.

“Our solution to be able to have an online [menu] platform that we can basically include into our website, with Bopple was amazing… that was a really good asset for us.”

“I'm able to do this on Lightspeed and then just push it out to Bopple, which is our online system, So it saves me double handling, which is really cool.”