The Australian hospitality industry has always been driven by its ability to adapt. Whether responding to shifting diner preferences, cost pressures or changes in how people spend their time, venues have long known how to evolve. But that evolution is taking on a new shape—one that goes far beyond the dining room floor.

Lightspeed’s Annual Hospitality Report reveals a clear trend: while dine-in remains the foundation of many businesses, it’s no longer the whole story. Cafes, bars and restaurants across Australia are exploring new ways to connect with their customers to bring in more revenue.

The question is: what does this diversification really look like? And what does it mean for operators trying to stay competitive in a fast-moving market?

In this blog, we’ll break down how different types of venues are building out multiple income streams, where the momentum is heading and what these shifts reveal about the changing landscape of Australian hospitality.

Let’s take a look.

- Dine-in isn’t dead

- Cafes are leading the charge on diversification

- Are restaurants leaving money on the table?

- Bars are building events into their business model

- The customer behaviour backing all this up

- Why diversification matters now more than ever

Stay one step ahead

Lightspeed has surveyed over 1000 hospitality operators and more than 2,000 consumers to show you which dining trends are on the rise in Australia in 2025. Download the full report for free today.

Dine-in isn’t dead

Let’s start with the headline: dine-in. It’s still the largest single revenue stream across the board, sitting at 31% nationally. But when nearly two-thirds of your revenue is coming from elsewhere, it’s clear there is money to be made from diversification.

So, where’s the rest of the revenue coming from?

Here’s how the national averages shake out:

These aren’t just side hustles—they’re core business. And for many venues, they’re the reason margins are holding steady despite rising costs.

Things get interesting still when we take a closer look at how this plays out across the different venue types.

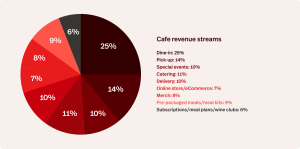

Cafes are leading the charge on diversification

Cafes, in particular, are punching above their weight when it comes to revenue diversity.

They generate the smallest proportion of income from dine-in—just 24%, compared to 31% for bars and 41% for restaurants—but they more than make up for it elsewhere.

Pickup, for example, pulls in 14%—higher than both bars (10%) and restaurants (11%), but it’s in the areas of pre-packaged meals and merch where cafes really set themselves apart.

Each of these streams contributes 8% to cafes’ bottom line, and there’s a good reason for this. Many cafes operate more like micro-marketplaces than traditional eateries.

Whether it’s jars of pickles, preserves and ferments at the counter, a fridge full of ready-to-go salads and sandwiches or branded tote bags and t-shirts, cafes are leaning into their role as lifestyle brands.

And this is a reflection of their place in Australian culture: fast, casual, community-driven and ideally suited for everything from a flat white to-go, to a fridge-friendly lunch you can eat at your desk, to a t-shirt and a tote to take down to the beach.

Cafes are true community hubs, offering a snapshot of their corner of the world.

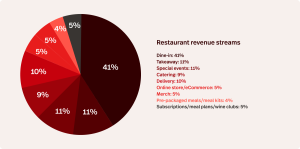

Are restaurants leaving money on the table?

Restaurants, by contrast, are still putting most of their eggs in the dine-in basket—with 41% of their revenue coming from in-house dining.

That makes sense, given the nature of the offering. Dining out at a restaurant is often about the experience—the ambience, the pacing, the service. It’s not something that translates easily into a takeaway container.

But even so, the data shows plenty of opportunity elsewhere, especially in areas like special events (11%) and delivery (10%). And while restaurants have lower averages in retail-style channels like pre-packaged meals (4%) and eCommerce (5%), even these smaller segments could offer breathing room for operators feeling the squeeze on traditional margins.

The rise of meal kits and curated wine clubs isn’t limited to the HelloFresh crowd. With the right branding and packaging, there’s room for high-end venues to offer something similar on their own terms—and their own price points.

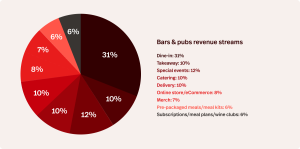

Bars are building events into their business model

Bars sit somewhere in between, with 31% of revenue from dine-in—on-par with the national average.

The events space could hold the key here.

And that’s because while special events account for roughly similar revenues as delivery, catering and takeaway for bar operators, many venues still treat them as occasional add-ons. But bars, unlike restaurants, are structurally built for flexibility: live music, themed nights (like trivia) and private hire. The infrastructure is there to take advantage of.

Much like the retail shelf in your local cafe, the social-first nature of a bar is a reflection of the greater community surrounding it. Only, they’re not showing you what physical goods the community can produce, rather they’re building the actual foundations of that community—the feel of the place, the vibe. They’re beckoning first-timers through their doors and giving them reasons to return.

The customer behaviour backing all this up

It’s not just merchant data pushing this story forward—customer habits are shifting too.

Australians are ordering takeaway more frequently than ever, rising 34% year-on-year between 2023 and 2024, vastly outpacing the year-on-year growth seen in dine-in (8%) and delivery (7%).

This surge in takeaway, paired with the relatively modest growth in delivery could be a clear sign that while convenience matters, added costs like delivery fees are making customers think twice.

And while the experience of dining out still holds strong cultural value, these numbers suggest that customers are increasingly open to engaging with venues in more modular, flexible ways—whether that’s ordering online, picking up a heat-and-eat meal or attending a Friday night gig instead of a full dinner.

One other stat that speaks volumes?

That might not seem like much to shout about on face value, but in an industry where visibility is everything, it’s an indication that these platforms are no longer just about convenience—they’re becoming powerful discovery tools, especially for newer venues or those outside traditional foot traffic zones trying to capture their piece of the market.

Why diversification matters now more than ever

So, what does all this mean?

Put simply, venue resilience is built on these types of diversification.

It’s no longer enough to be a great place to eat. The most future-fit venues are the ones thinking holistically about how people engage with them—not just where they sit.

- For cafes, that might mean scaling up pre-packaged meals and merch.

- For bars, it could mean locking in a monthly calendar of ticketed events.

- For restaurants, the opportunity might lie in premium takeaway bundles, branded products or curated at-home experiences.

Dine-in still matters—but it’s becoming clear that it’s only one piece of a larger puzzle.

This is not about abandoning what made your venue great. It’s about extending it—offering new ways for your customers to enjoy what you do best, whether they’re sitting in your booth, walking past your fridge or browsing your menu from the couch.

The most successful venues now are the ones meeting their customers where they are: in-store, online, at home or at an event. The data shows it’s not just possible—it’s already happening.

And while the exact mix will vary depending on your venue type, one thing is clear: the future of hospitality isn’t about having a single stream of revenue. It’s about building a whole ecosystem.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.