Retail POS system & payments

Maximise efficiency and team happiness

Manage inventory, suppliers, teams and stores from one retail platform. From easy-to-use POS and ecommerce tools to advanced reporting, Lightspeed has what you need to help you scale and succeed.

$90.7B USD

Lightspeed’s customers processed $90.7 billion in GTV through Lightspeed’s platform in fiscal 2024

~165K

~165K locations around the world trust Lightspeed**

15

Our experts have been guiding retailers for over 15 years

Simplify and scale.

Streamline your operations and accelerate growth with personalised workflows, payment capabilities and intuitive features that make life easier for your team.

Expert help 24/7

Enjoy dedicated and fast 24/7 support from retail specialists who know your business.

Unified commerce

Unite all your stores and channels to provide seamless experiences that delight customers at every touchpoint.

Gain visibility

Get real time insights into your sales, product and team performance with customisable reports available anywhere, anytime.

Turn pressure into possibility.

Watch the video to learn how Lightspeed makes growing your business easier—from sophisticated POS workflows and automations to insights that help you plan your next move.

The world's best businesses rely on Lightspeed

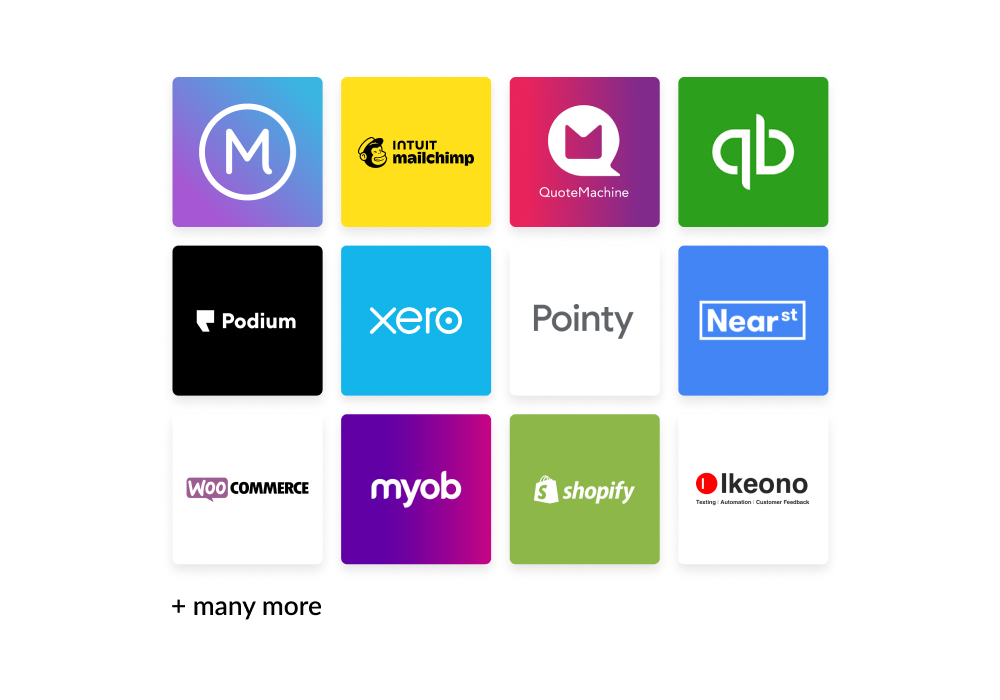

Integrate with best-in-class retail applications.

Extend the capabilities of Lightspeed. The platform integrates with the world's leading accounting software, ERP systems, marketing tools and more.

Considering the switch to Lightspeed?

Switching to Lightspeed is easy. From data migration to hardware and payments setup, our industry experts will support you each step of the way.

- Get fast 24/7 support

- One-on-one onboarding

- Dedicated Account Manager to answer every question

Try Lightspeed Retail for free

14-day trial. Unlimited access to all features. No credit card required.