One of the most challenging parts of owning a business is securing financing. There are plenty of options–so many that it can become overwhelming to figure out which one best suits your business needs. While merchant cash advances (MCAs) may not be the first funding method you consider, it’s worthwhile to understand what they are and how they work.

Merchant cash advances are a form of business funding provided by alternative lenders, fintechs, and other similar companies. They are available to most businesses, although admittedly they aren’t always a first-choice option. However, the MCA market is expected to be worth around $26 billion globally by 2029.

In this article, we’ll dive into the world of merchant cash advances. We’ll cover the following topics:

- What is a merchant cash advance?

- How merchant cash advances work

- Advantages of merchant cash advances

- Disadvantages and risks of merchant cash advances

- Comparing MCAs with other financing options

- Tips for choosing an MCA provider

What is a merchant cash advance?

A merchant cash advance is upfront working capital that’s provided to a business in exchange for future card sales. The advance and associated cost of the advance (in the form of a flat fee or factor rate–more on that later) are remitted through a percentage of your daily or weekly sales.

How do merchant cash advances differ from traditional loans?

Traditional loans entail borrowing a sum of money from a financial institution that are repaid over an agreed-upon period of time with interest. They involve comprehensive applications and collateral to help lenders mitigate risk.

Who are merchant cash advances for?

MCAs are ideal for businesses seeking short-term cash flow or who need funding for immediate business expenses. It’s also a useful option for businesses with a high volume of credit card transactions. Here’s a quick list of some of the other ideal profiles for MCAs:

- Seasonal businesses: Businesses that need an injection of cash flow due to seasonality and know that the remittance rate is proportional to their sales

- Businesses that don’t have great credit: MCAs don’t impact your credit score (or build credit)

- Businesses with limited tangible assets: For business owners that are wary of the collateral requirements that come with secured business loans

How merchant cash advances work

One of the main benefits of a merchant cash advance is the speed at which business owners receive funds. In other words, the process is quite simple. However, the general process can change depending on your MCA provider.

Important terms to understand

Holdback rate: This is the percentage of your daily or weekly sales that your MCA provider takes to remit your cash advance. This may also be called the remittance rate.

Factor rate: The factor rate is the cost of the advance expressed in a decimal amount, and the advance represents the total amount to be remitted. For instance, if a business receives a $10,000 advance with a factor rate of 1.2, the total amount to remit would be $12,000.

Flat fee: Similar to the factor rate, a flat fee is the cost of the advance. However, it’s calculated differently than the factor rate. A flat fee is a percentage of your cash advance added to the total amount to be remitted. In the case of the $10,000 advance, a flat fee of 12% would bring the total amount to be remitted to $11,200. Some providers operate on a flat fee basis, while others use factor rates.

Purchase amount: The purchase amount consists of the cash advance and its associated cost, either the flat fee or factor rate amount.

One general rule of thumb: carefully review the terms and conditions, fees, factor rates and the remittance structure before you proceed with your application.

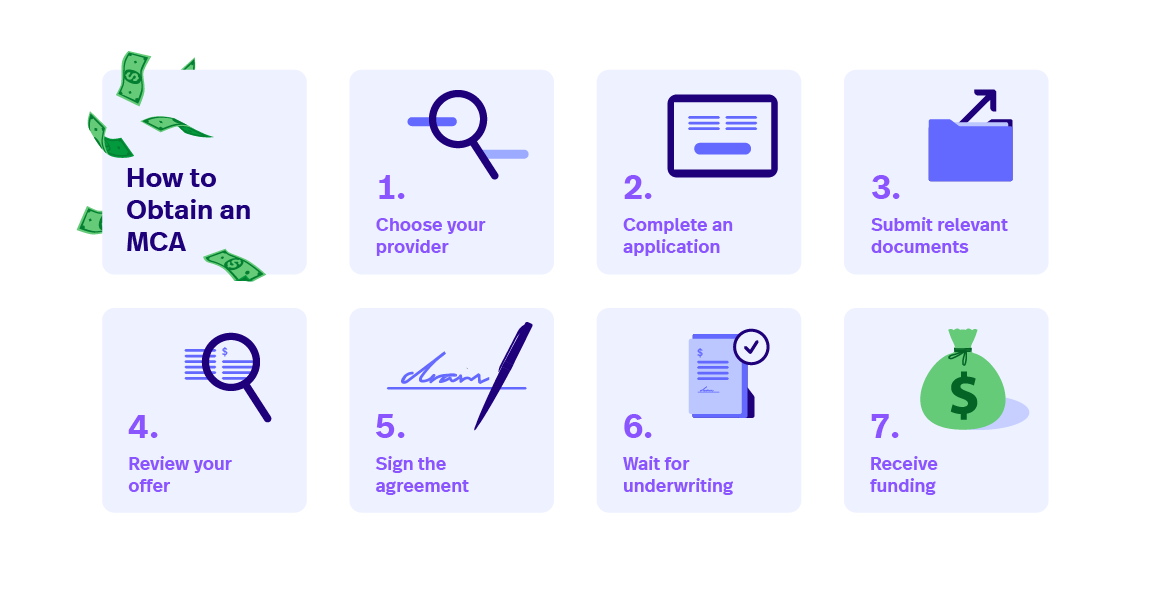

How to get a merchant cash advance

- Choose your MCA provider (we’ll discuss this in more detail later on)

- Complete an application.

- Submit relevant documents, usually payment statements and several statements showing your business’s credit card transaction history.

- Review your offer thoroughly. That includes the factor rate or flat fee and any other conditions.

- Once you sign the agreement, the provider will typically carry out a quick underwriting process.

- When that’s done, you’ll be approved and receive the funding shortly after.

- The advance will be remitted automatically through your daily or weekly sales until it’s remitted in full.

As with any type of business funding, you’ll want to do your due diligence in reviewing the offer and the provider you go with. If it’s your first time working with a certain company, it doesn’t hurt to consult a financial advisor or similar professional so they can give the offer another look before you sign anything.

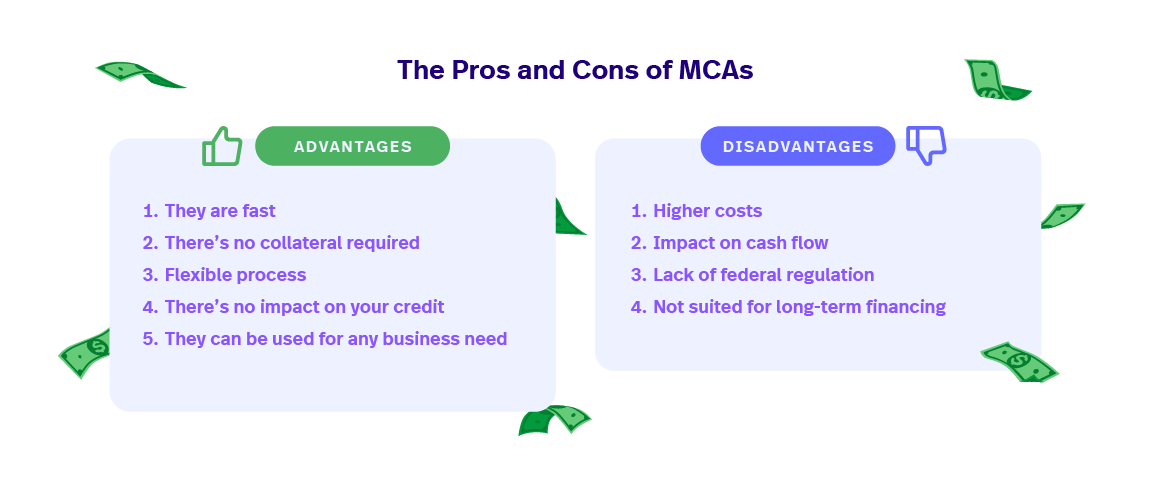

Advantages of merchant cash advances

1) They are fast

If you’re looking for last-minute capital, MCAs may be a good choice. They’re fast, with funding typically available within just a few days of applying. This is in contrast to some traditional forms of financing, which can take several weeks for approval, depending on the type and amount of funding. The speedy nature of this type of financing means that business owners can fund unexpected expenses or last-minute projects.

2) There’s no collateral required

This is a big plus for business owners who don’t have the means to put up any sort of collateral that is required with a secured business loan.

3) Flexible process

Unlike with traditional loans, you’re not penalized for ‘late payments’ because there’s no such thing with an MCA. As long as your sales are steady, you know that the advance is being remitted. Even if you made no sales on a given day, you won’t face penalties.

4) There’s no impact on your credit

MCA providers typically don’t conduct credit checks. This is a big benefit for business owners who want funding but don’t have a strong credit score. However, this means that you won’t be able to build credit, as you would with a loan when you make on-time payments.

5) They can be used for any business need

With traditional loans, part of the application process can include submitting a business plan that details how exactly you’re going to use the funds for your business. With an MCA, you don’t have to do this. As long as you’re using it for anything business-related, you don’t have to explain or justify your reasoning for requesting funding.

Disadvantages of merchant cash advances

There are a few reasons why business owners don’t typically turn to merchant cash advances as their first option when it comes to financing.

1) Higher costs

Despite a cash advance coming with a one-time cost or flat fee, these numbers can scare people away because they tend to be higher than the rates offered by traditional loans. If you’re considering choosing between a bank loan and MCA, translating the factor rate or flat fee into the loan equivalent–annual percentage rate (APR)–can help you compare costs.

2) Impact on cash flow

The daily or weekly automatic withdrawals may impact cash flow, making it difficult to pay for other operational and day-to-day expenses. Despite the fact that withdrawals are proportional to your sales, for businesses that are in a period of low sales, it can be difficult to manage. It’s important for every business considering an MCA to review their cash flow and any associated constraints related to daily withdrawals.

3) Lack of federal regulation

Merchant cash advances aren’t classified as loans and, therefore, aren’t subject to regulation.

Unfortunately, some predatory providers take advantage of the fact that there is no federal regulation of the MCA industry. These lenders often practice deceptive tactics and charge merchants unnecessarily. They may intentionally mislead businesses with unclear terms, administrative fees and other unexpected costs. This is obviously a huge stressor for businesses who believe they have signed up for a legitimate service. That’s why it’s extremely important to do your research before applying.

4) Not always suited for long-term financing

Traditional business loans may provide more long-term flexibility. In this way, merchant cash advances can be limited: they’re often better suited for short-term needs when businesses need fast funding for immediate expenses or projects.

Merchant cash advances vs. bank loans vs. business lines of credit

Two of the most common methods of business financing are bank loans and business lines of credit.

Bank loans: Businesses borrow a lump sum of money from a bank or other financial institution, which they agree to repay with interest over a predetermined period. A bank loan includes interest and a repayment schedule and usually requires collateral (these are secured loans).

Business line of credit: This is a flexible arrangement that allows a business to borrow funds up to a set limit. Merchants have ongoing access to capital and can use and repay the funds as they require. In terms of interest, they’re charged on the amount borrowed, which makes this a useful tool for both short-term and long-term cash flow needs.

Comparing MCAs vs. bank loans vs. business lines of credit

| Criteria | Merchant Cash Advance (MCA) | Bank Loan | Business Line of Credit |

| Funding Type | Purchase of future card sales | Lump sum amount | Revolving credit line |

| Repayment Structure | Daily or weekly percentage of card sales | Monthly fixed payments | Monthly minimum payments, revolving |

| Cost Structure | Factor rate or flat fee | Interest rate and possibly fees | Interest rate and possibly fees |

| Collateral | Unsecured | Secured or unsecured | Secured or unsecured |

| Approval Process | Quick approval with focus on card sales | Extensive application, credit checks, documentation | Application, credit assessment, documentation |

| Credit Check | Little to no emphasis on credit history | Typically requires good credit history | Credit history may influence approval |

| Speed of Funding | Rapid funding turnaround | Longer processing time | Generally quicker access to funds |

| Flexibility | Fixed terms, less flexibility | Fixed terms with less flexibility | Revolving, providing ongoing access to funds |

| Use of Funds | Typically unrestricted | Specific use determined by loan agreement | Flexible use, depending on the business’s needs |

| Risk of Default | Potentially high risk due to daily withdrawals | Risk of default if monthly payments are not met | Risk of default if minimum payments are not met |

| Suitability | Businesses with consistent credit card sales | Merchants with stable financials, good credit history | Businesses needing flexible access to capital |

When should you choose a merchant cash advance?

Furthermore, there are a few factors to consider when choosing a merchant cash advance over a bank loan or line of credit, including if:

- You have immediate funding needs

- Your business has a strong history of credit card sales

- You prefer not to put up collateral

- Automatic payment withdrawals sound good to you

- You don’t mind paying higher rates for faster funding turnaround

- You prefer your credit history isn’t assessed

Ask yourself whether any of these or all of them, apply to your situation. Seeking the advice of a professional can give you further insight into whether an MCA is a better option for you. They can also help you find the best provider–one that is transparent and trustworthy.

How to choose a merchant cash advance provider

Now that we’ve covered the advantages as well as the risks associated with a merchant cash advance, let’s talk about how you can choose a good provider. First, identify your business needs and make sure they align with what a merchant cash advance offers.

1) Research and compare

It’s important to conduct thorough research on MCA providers. You should compare their offerings, rates and terms. Be on the lookout for red flags, such as other unnecessary fees in the fine print. Check customer reviews on different websites and ask fellow business owners about their experiences with MCA services. Ask your financial advisors or similar professionals to provide you with detailed information or any other insight they may have on the services you’re considering.

Nowadays, many fintech companies provide merchant cash advances. For instance, POS and payment providers like Lightspeed, Shopify and Toast all offer their own merchant cash advance services. If your business works with a company like this–one that you already have a history with and trust your business with–it doesn’t hurt to look into their cash advance programs.

2) Understand terms and conditions

Once you’ve decided on a provider, review the terms and conditions of the agreement. Pay special attention to the flat fee or factor rate, repayment structure and any additional fees. Non-predatory MCA providers shouldn’t charge any extra fees, so this may be a red flag. It doesn’t hurt to have the agreement reviewed by a legal or financial professional so they can advise of any obfuscations or non-transparent terms.

3) Check the provider’s reputability

Although we may sound repetitive, we can’t stress enough the importance of making sure you’re working with a reputable provider. Customer testimonials, reviews and industry ratings, as well as trust ratings, can help you determine whether the company has a legitimate track record of working with businesses.

Understanding merchant cash advances

All in all, know your business needs best. Take the time to research your financing options so you can be confident in your choice, whether that is a merchant cash advance or bank loan.

Lightspeed’s merchant cash advance program, Lightspeed Capital, is available exclusively to eligible Lightspeed merchants. To learn more about the program, visit our website.

If you’re not yet a Lightspeed customer, talk to an expert about our POS and Payments solution for businesses.

Editor’s note: Nothing in this blog post should be construed as advice of any kind. Any legal, financial or tax-related content is provided for informational purposes only and is not a substitute for obtaining advice from a qualified legal or accounting professional. Where available, we’ve included primary sources. While we work hard to publish accurate content, we cannot be held responsible for any actions or omissions based on that content. Lightspeed does not undertake to complete further verifications or keep this blog post updated over time.

FAQ

1. What is an example of a merchant cash advance?

A merchant cash advance is when a business receives a lump sum amount upfront in exchange for a percentage of its daily card sales. Here’s an example of what that looks like:

Advance amount: $10,000

Flat fee: 12%

Total amount: $11,200

Holdback rate: 10% (the % of daily sales that is automatically withdrawn to remit the advance)

2. What is the difference between a loan and a merchant cash advance?

While both provide financing, loans involve borrowing a fixed sum with interest and fixed repayments, while merchant cash advances involve receiving a lump sum in exchange for a percentage of future card sales.

3. Are merchant cash advances legit?

Yes, merchant cash advances are a legitimate form of business financing. However, it’s crucial to carefully review terms and costs and choose reputable providers.

4. Can a merchant cash advance hurt your credit?

Generally, merchant cash advances don’t impact personal or business credit scores directly, as approval is based on daily credit card sales. However, financial strain from the remittance process could indirectly affect creditworthiness.

5. Why get a merchant cash advance?

Businesses may opt for merchant cash advances for quick access to capital, especially if they have consistent credit card sales, need rapid funding or face challenges obtaining traditional loans.

6. What happens if you don’t pay back a merchant cash advance?

Failing to repay a merchant cash advance may lead to financial penalties, increased fees, and legal action. It’s essential to communicate with the provider if facing difficulties.

7. Are merchant cash advances predatory?

While not inherently predatory, some providers may employ unfavourable terms. Businesses should carefully review agreements and choose reputable providers to avoid potential pitfalls.

8. How are merchant cash advances repaid?

Merchant cash advances are remitted via a fixed percentage of daily card sales, deducted automatically until the agreed-upon amount, including fees, is remitted in full.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.