Customer loyalty programs focus on marketing to your existing customers with the goal of bringing back customers and encouraging repeat purchases and higher value orders.

But one thing we hear from retailers almost every day is: Are loyalty programs actually worth it?

In this article, we cover:

- Costs of running a loyalty program

- Benefits of running a loyalty program

- Loyalty metrics you should track

- Are loyalty programs worth it?

Costs of running a loyalty program

1. The program itself

Depending how you do it, the cost of building and implementing a loyalty program can be anywhere from $100 (for a small run of stamp cards) to tens of thousands of dollars, with ongoing maintenance costs, for a bespoke loyalty app.

Retail giants, like Mecca Cosmetica, invest in custom-built loyalty programs for a premium brand experience and total control over functionality. However, this isn’t always a viable or efficient option for small-to-medium retailers.

At the other end of the spectrum, you’ve got small, single-store businesses who may opt for a simple physical stamp card. This is the cheapest form of a loyalty program (you’re pretty much just looking at printing costs here).

Then you’ve got small-to-medium businesses. These retailers want the benefits of customer purchase analytics that you won’t find with a stamp card, but don’t want to fork out $200+ per hour to a development agency for a custom app.

This is the Goldilocks zone (not too big, not too small, just right). Retailers sitting in this camp can expect to pay around $60-$200+ per month for loyalty program software. At the upper end, you’re looking at products that integrate seamlessly with sales software and ecommerce apps, or platforms that offer loyalty as part of a broader marketing suite (with all marketing activity tracked in one place).

Image source: Mecca.com.au

2. Maintenance costs

Physical stamp cards don’t have attributed maintenance costs per se, as they simply require printing on an as-you-need it basis.

Custom apps may require ongoing work at your developer’s hourly rate. Any new integrations or change in systems or sales software could incur large costs. Bugs, updates, customer data security and more will all be your responsibility.

Back in the Goldilocks zone, you’ve got cloud-based loyalty software—where you’ll enjoy a totally hands-off maintenance experience. Bugs and updates, new features, new integrations and data security are all taken care of by the technology provider as part of your monthly subscription.

3. Management and reporting

This is where physical stamp card programs hit massive roadblocks. Keeping track of the program and its impact means lots of time spent doing manual data entry and updating spreadsheets. All this makes it nearly impossible to know whether you’re seeing a return on your investment.

When done well, custom apps can provide extremely powerful data. Of course, brands spending tens of thousands of dollars on these custom-built solutions will have entire teams dedicated to customer data analytics, loyalty insights and optimization.

Subscription-based loyalty software typically comes with pre-built analytics and dashboards tracking all the metrics you need from your loyalty program. The only cost involved in reporting is a few minutes of your time to check the dashboard and see how your customers are engaging.

4. Marketing and promotion

Every loyalty program has at least some marketing and promotion costs—you want your customers to actually know about it! Generally, the marketing cost required scales with the size of your business, and the type of loyalty solution you choose (stamp-based, subscription-based or custom-built).

Benefits of running a loyalty program

Watch Webinar: Loyalty Program Best Practices

Real-world loyalty marketing tips and tactics that you can apply right away to drive customer engagement and retention.

1. With the right software, you can measure ROI

Find loyalty software that connects to your e-commerce and POS systems. That way, you have the ability to track sales from your loyalty program and therefore your ROI. This is incredibly powerful, and a good reason to invest in a bit more than just a stamp card loyalty solution.

2. They spread discounts across multiple transactions

Let’s bust a myth: loyalty programs are anything but a cheap discount tactic!

By spreading your discounts across multiple transactions, you’re only rewarding people who come back again and again and who spend above a certain amount. That means discounts are weighted toward your best customers (that sweet 20% bringing home 80% of the bacon). Plus, you get time to build your customer relationship across those purchases, rather than running broad-stroke sales that only attract fickle deal-hunters.

3. Done right, they enhance customer experience

We say ‘done right’ because loyalty programs do require a bit of effort and commitment! Badly-executed loyalty programs are out there in the wild… and they can be detrimental to brand affinity. Many have disjointed in-store and online experiences—if they work with ecommerce at all—which fails to take into account how omnichannel customers are today. Most of the time, these problems pop up when loyalty programs have been added as an after-thought, without any strategy or planning.

The best loyalty program offers genuine value to your customers, online and off. When your loyalty program is 1) simple to understand, 2) offers tiered rewards and 3) community-centric, you’ll create an experience that’s actually valuable to your customers.

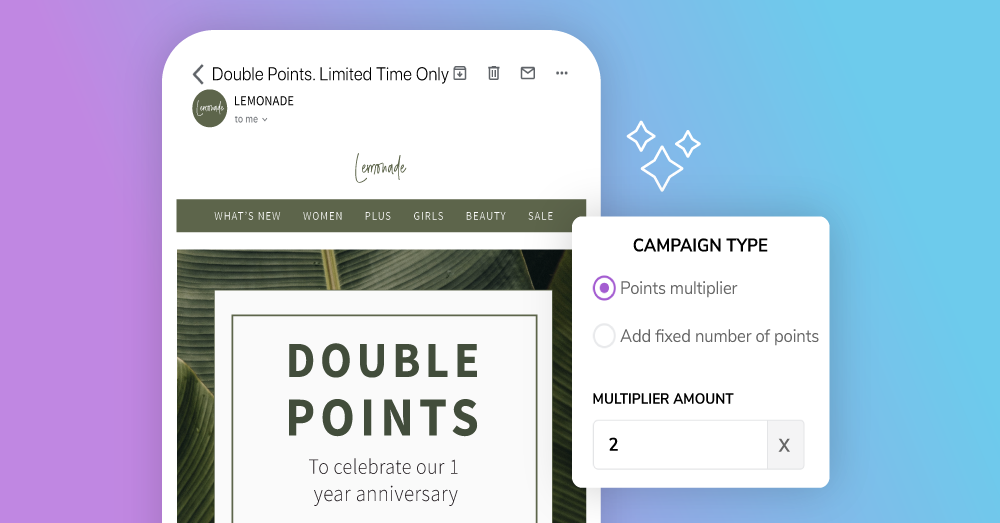

Mecca’s Beauty Loop does this really well. In their tiered program, higher value customers receive more elaborate gift-boxes direct to their home address as a thank you. There are lots of different ways to generate buzz and engagement for your loyal customers. Run VIP campaigns like Double Points Days, or event-specific offers. Think about what your customers respond to, and don’t be afraid to deliver the warm fuzzies!

| Did you know?

More than half (53%) of loyalty members say they are interested in incentives to earn extra points or status levels. |

4. They act as a cost-effective marketing channel

We know two things:

- It costs 5 times more to acquire a new customer than to keep an existing one.

- 80% of profits come from 20% of customers (i.e., your regulars).

Yet still many retailers are spending too much on acquisition and not enough on customer marketing. That’s not because they’ve made a conscious, strategic decision to allocate budget in this way, it’s simply because they don’t have visibility over the right data.

Marketing suites like Lightspeed Advanced Marketing can wrap around your entire marketing strategy, with tools like a loyalty program, email campaigns, social media posting, SMS messaging, Google Review management and more. With software like this, you can see the return on all your marketing activities, and make adjustments to optimize your spend and resulting sales.

5. They mitigate price perception

In a KPMG survey of consumers, 60% of participants said they would shop at a store with slightly higher prices in order to earn a loyalty program reward. In these cases, the customer perceives the value of the reward to be greater than the price difference.

6. Customers are incentivized to give your their contact details

Loyalty programs are about a lot more than just loyalty. They’re a customer marketing tactic—giving your customers something back for handing over their details. When you attribute a sale to an actual person, you create a customer profile. Each time that customer comes back, they are happy to self-identify, as they’ll get points in return. That gives you the data you need to track all the important metrics I’m coming to next!

Loyalty metrics you should track

To make sure you’re getting the most out of your loyalty program you should be tracking these 3 key metrics.

1. Return on Investment

Whether you’re spending $10 or $10,000 on your loyalty program, it’s only worth it if you’re making that back (and more!) in revenue. Lightspeed Advanced Marketing tracks the sales that are coming directly from your loyalty program, so you get complete visibility of the impact it’s having on revenue.

2. Purchase Frequency

How many times do your customers purchase from you? This is a really key metric to track—you want to keep customers coming back. Track your purchase frequency over time, and see how it differs between your customer segments.

3. Average Customer Lifetime Value

Average Customer Lifetime Value is the value (revenue, in dollars) that each customer brings to your business over the course of their relationship with your brand (their “customer lifetime”).

A good loyalty program will get customers spending more on average. Overtime, the goal is that your customers become more and more valuable to your business. If your average customer lifetime value is increasing over time, each new customer in your database becomes worth more.

4. Redemption Rate

Did you know that the average person is signed up to 14.8 loyalty programs, but is active in less than half of them? The redemption rate is the percentage of rewards actually redeemed (rather than sitting idly in customer accounts). Your redemption rate essentially shows you how engaged your customers are in your program.

A low redemption rate means customers aren’t invested in the program, have forgotten about it, or don’t know how to redeem their rewards. A high redemption rate tells you that your customers understand how your prorgam works and the value they get from it.

5. Average Order Value

Average Order Value is self-explanatory—a metric most retailers track already. However, it’s important to track how your AOV changes after introducing a loyalty program. Loyalty points incentivize customers to spend that little bit extra in a transaction, so you should see this increase over time.

Are loyalty programs worth it?

The value of loyalty programs is not limited to increasing customer transactions. They work to increase other key retail metrics such as your average order value, customer lifetime value and purchase frequency.

Beyond that, a well-executed, brand-aligned loyalty program will enhance your customer experience and deliver genuine value.

Verdict: Yes!

Most critically, you need to be able to connect your loyalty program to your sales channels (in-store and online) so you can measure the direct revenue you’re generating. That way, you’ll quickly be able to determine whether the benefits and returns outweigh the costs involved.

See it in action – free demo

Lightspeed Advanced Marketing makes it easy to set up a loyalty and rewards program to increase repeat visits with no apps or websites required.

- Easy to get started with POS sign up

- Customers can receive and redeem points in-store or online

- Offer dollars, discounts or products as rewards

- Award points for purchases, social actions or referrals

- Create exclusive membership tiers and offers

- Send points balances and reminders

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.