So, there was this one sandwich that followed me from kitchen to kitchen. And no matter how much I protested, how deep I dug my heels in, or how ready I was to suspend reality for just one perfect, blissful moment, the truth was that this sandwich was just too good to retire.

I had to face this fact on many occasions. Such is the true cost of creating something that works as well as it did.

And this got me thinking.

Just how good a thing had I done here? I knew it was tasty, yeah, but it was also really, really cheap compared to similar offerings in the local area. Surely I was losing money by having the thing so affordable?

Perhaps not.

You see, we’re going to be doing some maths (I know, but indulge me, please). And though the mere thought of a parade of figures is enough to make my eyes cross, it turns out it’s really simple. And hey, if I can stay awake long enough to write these formulas, you can almost certainly give them a read. (Plus, you get a really solid cheese toastie recipe in the bargain)

I’ll be breaking down this article into these different sections:

- COGS formula: how to work yours out

- Calculating your profit margins

- Working out your markup

- Margin vs markup: a tale as old as time™

COGS formula: how to work yours out

Before you can begin to calculate margins for your restaurant, you have to start at the very bottom of the chain, the fundamental figure upon which all of your formulas will be based. I’m talking, of course, about your cost of goods sold.

Your cost of goods sold, or COGS, is essentially what you have paid for the raw ingredients for your dish. Without this figure, you can’t accurately calculate your margins, or your markups.

So, how do we do this? *WARNING: MATHS AHEAD*

Okay, the warning might have been a bit dramatic, because your COGS formula is actually the simplest of the lot.

You just add up how much you paid for each ingredient that you are going to use.

Pretty easy, right?

Well, yes and no.

Working out how much you have paid for each ingredient involves more than just checking your invoices and seeing how much came out of your bank account. You need to figure out how much of that ingredient you have used per serve.

This is where a good set of scales comes in real handy.

Most goods are sold by the kilo, so when you are writing out new recipes, it’s a good idea to weigh each ingredient out as you add it. Not only will this give you an exact recipe to follow, it will also help to calculate how much you have paid for each ingredient, which in turn will tell you how much the entire dish has cost you to make, or your COGS.

How does this look in practice?

Let’s go back to my cheese toastie, shall we?

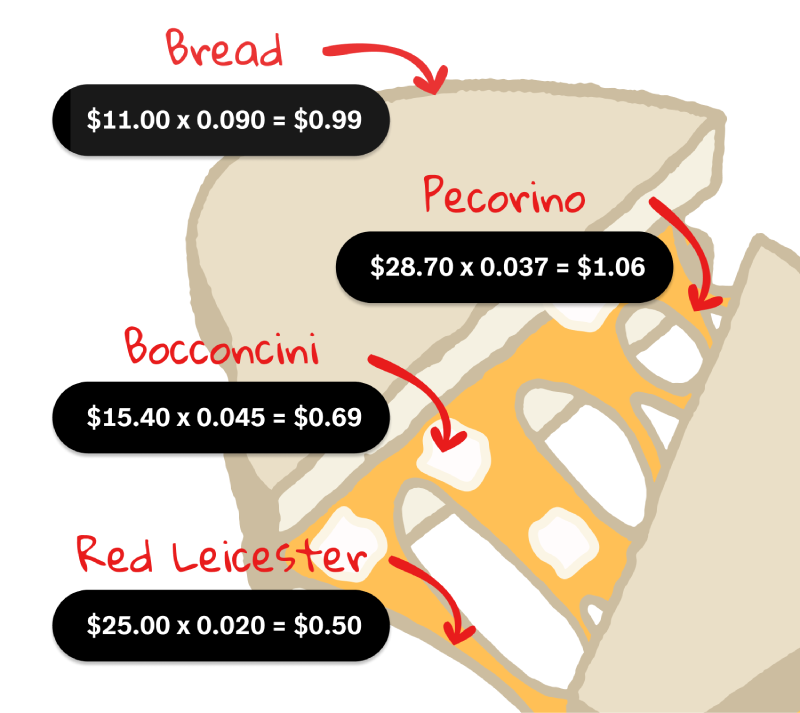

I used 2 slices of bread, weighing a combined 90g (0.090kg), 37g (0.037kg) of pecorino, 45g (0.045kg) of bocconcini, and 20g (0.020kg) of red leicester.

My bread cost $11.00 per kg, pecorino costs $28.70 per kg, bocconcini is $15.40 per kg, and red leicester costs $25.00 per kg.

To calculate how much I’m spending on each ingredient, I have to multiply the cost per kg by how much I’d be using.

This makes for a total COGS of $3.24

Calculating your profit margins

Now, it would be all too easy to take that COGS figure, and go ahead and price up your menu item. Hell, I did just that and stumbled into a gold mine (well, maybe a less precious metal, but you get the picture).

But by doing that, it leaves you in the dark about the true cost of running your business. Put simply, the more you know about the finances behind your menu, the more you can harness it’s potential for boosting profits.

By calculating your profit margins, you can see how much of your profits go towards making the dish, against how much of the profits go towards that 2nd summer home you’ve been saving up for.

And whilst this formula has a bit more to it, it’s still straight forward enough for somebody as simple as me to grasp.

So, what is this profit margin formula of which you speak?

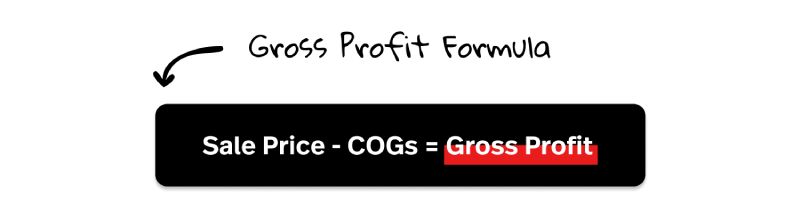

Do you like algebra? Yeah, me neither, but get this, your profit margin formula is actually just:

Boom! Algebra. That’s it.

Boom! Algebra. That’s it.

But how do I know what my gross profit is?

Get ready for some of the easiest maths you’ll ever do.

To calculate your gross profit, you just subtract your COGS from your sale price.

As far as your sale price goes, this is the time to play around with it. Change the number up until you find that sweet spot between an affordable meal for your customers, and one that’s not too shabby in returning the favour to you either.

As far as your sale price goes, this is the time to play around with it. Change the number up until you find that sweet spot between an affordable meal for your customers, and one that’s not too shabby in returning the favour to you either.

Profit margin formula in practice

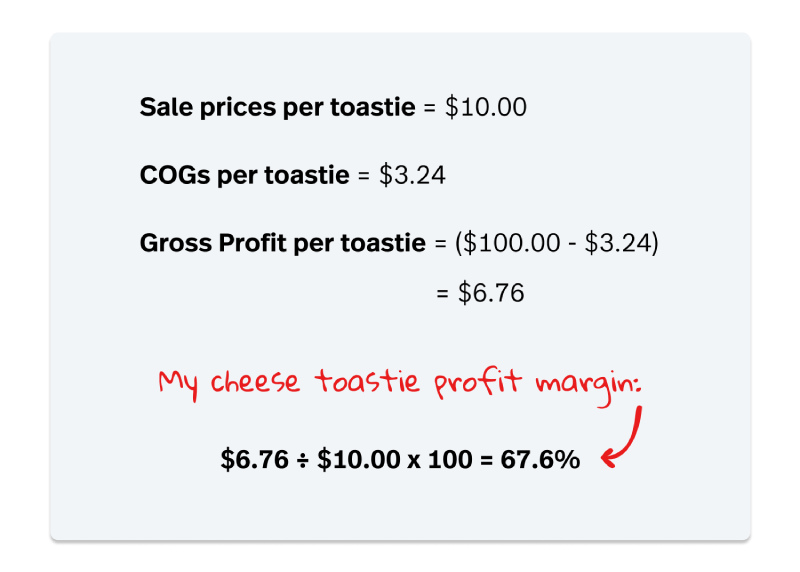

So, I mentioned before that for my toastie I didn’t work out my profit margin before pricing it up. I just slapped a $10.00 price tag on the thing and watched it fly out the kitchen with stunning regularity.

Rookie move.

If I had calculated my profit margin, I’d have been a lot happier to see order, after order, after order come through. It certainly would have given my aching right arm some comfort, knowing that the cumulative years spent grating Italy’s GDP in pecorino every shift was paying off handsomely.

So, let’s work this out.

Give me a second whilst I casually brush this dirt off my shoulder (or was it pecorino?).

Working out your markup

This is where things get interesting.

While calculating your markup can tell you how profitable an individual menu item is in dollars & cents, it also informs you on how much higher your sale price is than your COGS in a strictly percentage expression.

Essentially, it can measure how much you have inflated your sales price in comparison to your COGS.

Are your eyes crossed yet? Stick with me here, there’s not much longer to go, scout’s honour.

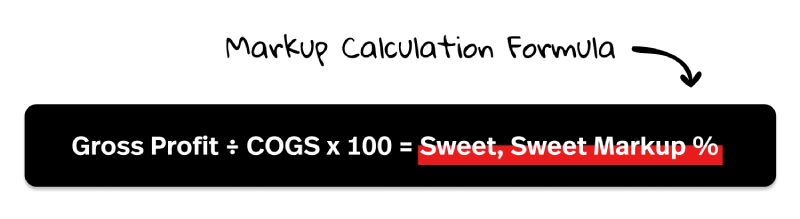

Markup calculation formula

To calculate your markup as a dollar & cents figure, just look above at your gross profit. That’s it. That’s your markup.

To calculate your markup, as a percentage (because hey, who doesn’t love a percentage around here?), you simply divide your gross profit by your COGS, then multiply by 100.

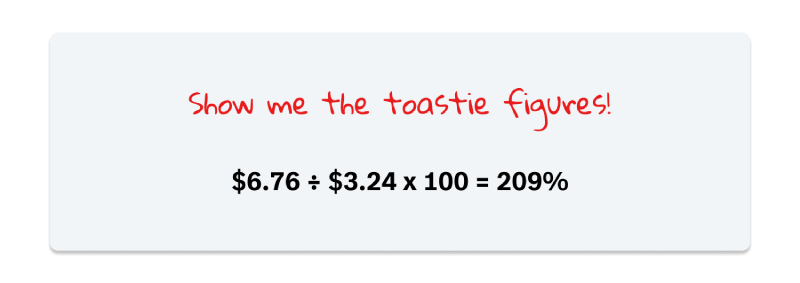

Enough chit-chat, show me the toastie figures!

Okay! Easy there…erm…me.

So, we’ve already worked out my gross profit ($6.76, for those playing at home), and my COGS ($3.24) is old news, so I won’t bore you again with those equations.

Let’s get straight into it

I’m telling you, when the hungover crowd came in on the weekends it was like printing money.

I’m telling you, when the hungover crowd came in on the weekends it was like printing money.

Margin vs markup: a tale as old as time™

So, we’ve worked out our profit margins, and our markups, what now?

A lot of people get confused about margins vs markups, and they end up pricing something based on what markup they want, when they really should be focussed more on the margin when it comes to deciding the sale price.

What are the differences between margins & markups, really?

That’s a good question, and one that many a budding restaurateur has asked themselves before.

Profit margins are what you should use to price your menu (do it, it’s the smart option). You can keep turning a more consistent profit as this is based on your sales price, which is 100% under your control.

By pricing based on a margin, your profits are essentially on your terms.

Your markup is more a means of gathering general information regarding your margin. It allows you to delve deeper into what kind of ingredients you can…well…markup more, meaning you can see where there is more gross profit to be made.

If a certain ingredient has a history of selling at a higher markup, you can be sure that using it in a menu item stands a better chance at yielding a higher profit.

Similarly, if something doesn’t usually sell at a high markup, then it’s probably best to give it a miss.

Is there time for one more toastie example?

If you’ve made it this far, of course there is!

So, if I priced my toastie for a 67.6% profit margin (like I did), then my gross profit per toastie would be $6.76 (like it was), right?

But if I were to price it at a 67.6% markup, then my gross profit would only be $2.19. This is because by marking up based on COGS being $3.24 by 67.6% , that would give me a sale price of only $5.43. Not only is that a horrendous price with regards to a cash register float, it’s making me miss out on so much potential profit.

But by looking at the markup of the toastie, you can see that, as a menu item, the markup is incredible. I’m now starting to see why I couldn’t escape this sandwich.

But beware, this toastie is an outlier. Pricing everything at a 67.6% margin would be unwise, to put it politely. It’s just a good way of understanding why this sandwich was so popular with customers, and bosses alike.

To get a good idea of how to price your menu, I’d recommend using a food cost calculator. There, you can find built-in formulas that show you your COGS, markup, margin, and sale price. You can also get an in-depth breakdown of your recipe’s costs using our recipe costing calculator.

Now go, and price the hell out of your menu!

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.