In the ever-evolving landscape of Australian retail, it can be difficult to predict what challenges and trends lay around the corner.

To help retailers prepare for the year ahead, we’ll delve into the insights from our Retail Insights and Shopper Sentiment Report for 2024 to explore the enduring importance of brick-and-mortar retail, the pivotal role of loyalty programs, and the interdependent relationship between online and offline shopping channels.

- The resilience of brick-and-mortar retail

- The shopping channel duality

- Phygital retail: the bridge between digital and physical

- Omnichannel approach is non-negotiable

- Loyalty programs are more than discounts

Free Download: Retail Insights & Shopper Sentiment for 2024

A survey of 750+Australians reveals customers' shopping preferences and share actionable insights for retailers.

The resilience of brick-and-mortar retail

The Covid-induced e-commerce boom led many to speculate that the era of brick-and-mortar stores was over.

However, our report found that physical stores are here to stay. The data highlights how the appeal of in-store shopping is not diminishing; instead, it’s evolving – particularly when retailers adapt to the needs of the modern consumer.

The report indicates that 76% of consumers continue to shop in physical stores at least once a month, highlighting how there’s still a strong appetite for in-store shopping.

In addition to Lightspeed’s data, a global study of over 50,000 people across 26 countries also revealed that 73% of Australians prefer to shop in-store – compared to the global average of 59%.

The appeal of in-store shopping

Aussie consumers, it seems, crave the tactile experience unique to physical stores.

According to the report:

- 56% of shoppers visit brick-and-mortar stores to check out products in real life

- 46% of shoppers like to compare similar products within the tangible setting of a retail store.

This desire to touch, see and experience products suggests that online platforms, while convenient, can’t replace the need to physically interact with a product before making a purchase.

What’s next for brick-and-mortar retail?

As we navigate the next few years, the key to success for brick-and-mortar retail lies in understanding and meeting changing customer expectations.

Our report underscores that customers now demand greater convenience and additional services from in-store shopping, and there are several key factors that consumers take into consideration before deciding where to shop. For example:

- 42% of shoppers check online for stock availability before their in-store visits

- 39% of shoppers favour stores with loyalty programs

- 21% of shoppers are drawn to gift cards and various gift choices

- 15% of shoppers will shop in a store with layby/buy-now-pay-later options

These insights emphasise the need for retailers to prioritise stock availability, loyalty programs, and flexible payment options to cater to the diverse needs of the modern shopper.

The shopping channel duality

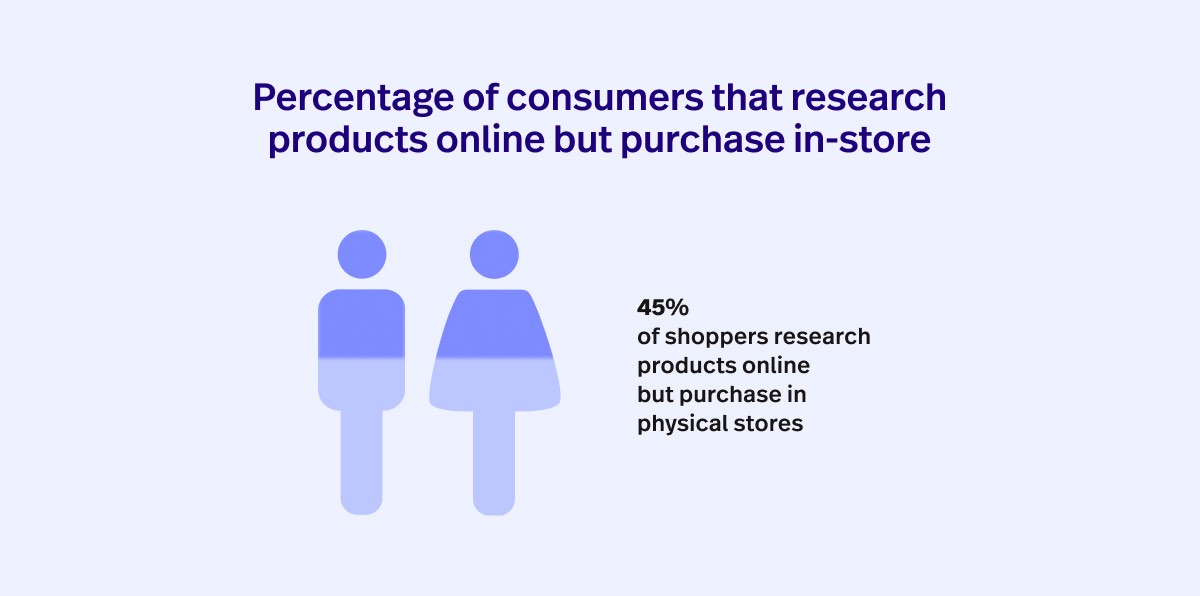

Lightspeed’s report reveals that 45% of shoppers research products online but purchase in physical stores, highlighting a unique shopping channel duality.

As we progress through 2024, it’s important to harness the potential of this significant customer segment by crafting solutions that enhance the overall online and in-store shopping experience.

Creating or optimising a user-friendly e-commerce website is a great place to start.

Your website should facilitate product discovery, allowing customers to seamlessly explore categories, research products, read reviews, and compare prices. You should also consider highlighting in-store promotions on your website to entice consumers from online research into physical shopping.

Employing other forms of technology can also help optimise the connection between your online and physical stores.

For example, mobile apps, QR codes, and interactive kiosks bridge the gap between online research and in-store purchases. Mobile apps provide easy access to product information, QR codes offer instant details on scanned products, and interactive kiosks enhance the experiential aspect of in-store shopping.

Addressing stock availability

One of the most interesting takeaways from our report highlights the convenience of checking online for in-store stock availability before visiting a physical store.

As we mentioned earlier, 42% of shoppers check online for stock availability before their in-store visits, providing retailers with an opportunity to embrace in 2024. With such a large portion of consumers deeming stock availability crucial, it’s essential to consider implementing a strategy where online and offline channels complement each other.

Technology, once again, emerges as the key.

A unified retail platform, like Lightspeed, that integrates e-commerce with point of sale allows for default inventory tracking and automated updates across shopping channels. This seamless synchronisation ensures that changes in inventory, whether online or in-store, are reflected instantly, providing real-time information to both retailers and customers.

Phygital retail: the bridge between digital and physical

Phygital retail–the seamless integration of physical stores and digital platforms–is far from a new concept, but its influence is gaining momentum as consumers seamlessly transition between online and in-store experiences.

Our data paints a clear picture of phygital retail at work in the real world.

For example, the data shows that 45% of consumers first research products online before making a purchase in-store. On the flip side, 17% use physical stores to research products and then complete their purchases online.

This interplay between digital and physical retail explains the evolving role of brick-and-mortar stores.

As we move through 2024, it’s crucial to focus on creating an effortless transition between in-store and online shopping, recognising that consumers expect a unified and cohesive shopping experience.

The successful retailers of the future will embrace the connection between digital and physical retail, creating an immersive, omnichannel shopping journey.

Omnichannel approach is non-negotiable

The trend towards phygital retail emphasises how an omnichannel approach is non-negotiable when trying to connect with customers in the dynamic landscape of Australian retail.

It can often be tempting to favour one channel over another, especially if you’ve seen historical success or if one channel has previously outperformed another.

However, if you’re looking to grow in 2024, it’s clear that omnichannel is not just a choice but a strategic imperative. As a starting point, you’ll need to focus on understanding which channels to prioritise based on your target customers and product offerings.

However, striking the right balance between channels can be challenging, and you must understand the needs of your target consumers, the role each channel plays, and the nature of the products being sold.

It’s also important to acknowledge that different channels can play different roles in the customer journey and experience. While online platforms are popular for browsing, reading reviews, and price checking, in-store experiences remain unmatched for touching and feeling a product.

Know your audience

When choosing the best omnichannel approach for your retail business, it’s essential to understand how your customers engage with specific products, allocating resources accordingly across online and in-store platforms.

While educated guesses can go a long way, using data to back up (or dispel) your presumptions is a must.

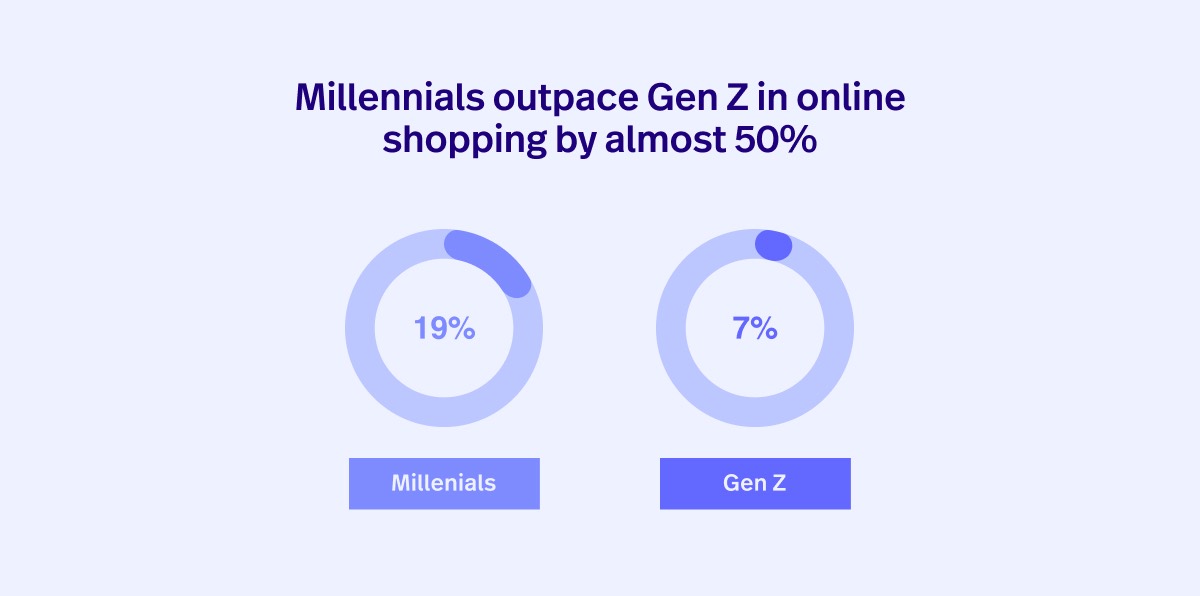

For example, our report dismisses the commonly held notion that the younger generation are the most avid online shoppers. The research found that Millennials outpace Gen Z in online shopping by almost 50%, emphasising the importance of understanding the distinct preferences of different age groups.

Marketplaces: an emerging retail channel

Aside from online and in-store shopping, our data points towards several other channels that retailers should consider in 2024 and beyond.

Marketplaces, for example, serve as early-stage platforms for browsing and product comparison. While marketplaces play a crucial role in raising awareness, they often don’t culminate in immediate sales.

Our data shows that under 20% of Millennials and under 10% of Gen Z purchase products from Marketplaces.

However, marketplaces are a growing channel that should be considered by retailers looking to expand in the coming years.

For example, The Woolworths Group has recently opened its online stores to third-party sellers by launching Woolworths MarketPlus – highlighting the growing demand for marketplaces in Australia.

Woolworths MarketPlus will allow third-party merchants to sell products across the supermarket chain’s businesses, including MyDeal, Everyday Market, and the newly launched Big W Market.

Looking forward, it’s evident that omnichannel retail will continue to revolutionise the industry. Therefore, retailers who aim to create a seamless transition between physical stores, websites, marketplaces, mobile apps, and social media will better cater to consumers’ growing appetites for convenience and personalised experiences.

Loyalty programs are more than discounts

While marketplaces are an emerging channel for retailers, loyalty programs remain a crucial tool to leverage in 2024. According to our data, loyalty programs are valued by 2 in 5 shoppers, and 39% of consumers say loyalty programs influence their decision to visit a brick-and-mortar store

A strategic, well-designed loyalty program not only entices people to return to your store, but it also serves retailers post-purchase, offering invaluable data for targeted marketing campaigns and customer retention.

Aside from encouraging customers to return to your store, loyalty programs, when executed well, also drive higher customer spend. According to recent loyalty research, 49% of consumers agree they’ve spent more after joining a loyalty program, and 66% say the ability to earn rewards changes their spending behaviour.

A strategic approach to loyalty

While the traditional approach of earning points for discounts remains effective, retailers must broaden their horizons in 2024 to better engage consumers.

For example, offering tiered rewards or early access to exclusive offerings could be a great way to switch up your loyalty offering to entice more customers to make a repeat purchase.

Another thing to consider is personalisation. Our report found that 1 in 4 respondents expressed a preference for tailored experiences. Therefore, including personalised product recommendations into your loyalty program could be a great way to appeal to this cohort of customers.

A recent survey by Yotpo further supports this idea, finding that consumers are looking for more than just discounts or free shipping.

When asked: What would you want out of a loyalty program, other free shipping and discounts? 60% of respondents said they’d like early access to sales, 51% said they’d like early access to new products, and 39% said they’d enjoy offers and recommendations tailored to them.

Embracing the future of retail

At present, the retail industry finds itself at a crossroads, where the blend of traditional brick-and-mortar stores, the convenience of online shopping, and the spectrum of customer loyalty unite to create a unique shopping experience.

Australian retailers who are ready to embrace change are perfectly placed to reshape their business and evolve to meet changing customer demands. Those who take the time to understand the nuances of this evolving landscape will be better placed to embrace innovation and customer-centric strategies to thrive in this dynamic era of retail evolution.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.