![750 Voices on the Future of Shopping in Australia [Shop Talk 2024]](https://blog-assets.lightspeedhq.com/img/2024/01/0cbc2444-blog-3_-750-voices-on-the-future-of-shopping.jpeg)

As we enter the new year and navigate through the first few weeks of 2024, it can be challenging to predict what evolving expectations consumers will have when it comes to their shopping experience.

To help retailers prepare for the year ahead, we’ve gathered insights from the people who matter – your customers. Our in-depth report, Retail Insights & Shopper Sentiment for 2024, covers over 50 insights from over 750 Australian consumers. However, in this article, we’ll dive into 12 of the most interesting data points from the report to understand the recent shift in consumer behaviour and what customers expect from retailers in 2024.

So whether you’re looking to grow your business or simply understand the evolving retail landscape – let this be your go-to guide for customer sentiment and the future of shopping in 2024.

12 consumer shopping insights for 2024

- Physical stores are still the most preferred way of shopping

- Gen Z aren’t the most frequent online shoppers

- Loyalty programs remain important

- Tangibility is the key driver for in-store shopping

- Omnichannel shopping is increasingly popular

- Additional services can make a difference

- Accurate stock availability is crucial

- Pricing concerns discourage people from in-store shopping

- Marketplaces are an emerging shopping channel

- Special deals are crucial for encouraging local shopping

- Personalisation is important in local retail

- Returns policy influences purchase decisions

Prepare your retail store for the year ahead

Download our free guide that reveals customers' shopping preferences and habits and shares actionable insights for retailers in 2024.

1. Physical stores are still the most preferred way of shopping

One of the most interesting insights from our report was the prevalence of physical shopping, with over three-quarters of Aussie shoppers saying they shop in-store for non-essential items at least once a month.

The Covid-induced e-commerce boom led many to speculate that the brick-and-mortar era was over. However, our data points towards the resilience of in-store shopping, with a resounding number of customers still showing a strong appetite for physical retail.

2. Gen Z aren’t the most frequent online shoppers

Interestingly, the report debunks the widely held belief that Gen Z (born between 1996-2010) are the most frequent online shoppers. Instead, their older counterparts, Millennials (born between 1982-1995), outpace Gen Z in online shopping by almost 50%.

These insights remind us that while educated guesses can go a long way, using data to back up (or dispel) assumptions is a must, particularly when creating strategies to appeal to new customers in 2024.

3. Loyalty programs remain important

Loyalty programs have long been an essential tool for retailers, and our data shows loyalty initiatives still hold considerable influence over consumers, with 2 in 5 shoppers saying loyalty programs influence their decision to visit a brick-and-mortar store.

Interestingly, there is a noteworthy gender disparity within this finding – with females (44%) placing greater importance on loyalty programs than males (33%).

4. Tangibility is the key driver for in-store shopping

Aussie consumers crave the tactile experience that physical stores uniquely offer, with our report highlighting how over half of shoppers visit brick-and-mortar stores to physically see and feel products. To reiterate this point further, the data shows that 46% of shoppers want to have the ability to compare similar items in person.

This desire to touch, see and experience products suggests that online platforms, while convenient, can’t completely replace the need to physically interact with a product before making a purchase.

5. Omnichannel shopping is increasingly popular

The bridge between physical and online retail is a recurring trend in our research, and omnichannel shopping will be instrumental for retailers in 2024.

Our data highlights how customers now expect a seamless transition between physical stores and online channels, with nearly half of shoppers researching products online before purchasing in-store. On the flip side, 17% of shoppers do their research in-store and then buy online.

6. Accurate stock availability is crucial

When asked what is most important when shopping, consumers gave a resounding answer: access to accurate stock availability.

More than two in five customers check stock availability online before visiting a store, highlighting a growing need for websites to reflect accurate in-store inventory levels – providing real-time information to customers.

This further reiterates how consumers now expect a unified and cohesive omnichannel shopping experience, and there should be an effortless transition between in-store and online shopping.

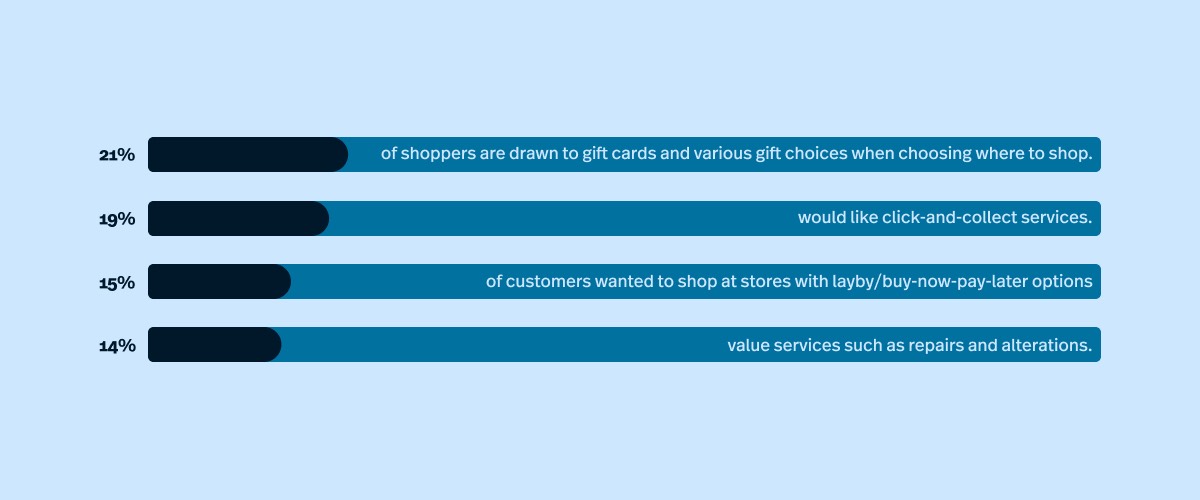

7. Additional services can make a difference

Aside from checking stock availability and loyalty programs, our data shows that a growing cohort of customers also want additional services from their favourite retailers.

One in five shoppers expressed a preference for gift cards and other gift options, while 19% would like click-and-collect services. The data also highlighted how 15% of customers wanted to shop at stores with layby/buy-now-pay-later options and 14% value services such as repairs and alterations.

8. Pricing concerns discourage people from in-store shopping

With an ongoing cost of living crisis and rising inflation, it’s unsurprising that price is a major factor in consumers’ purchasing decisions.

Our report shows that one-third of Aussie shoppers are discouraged from shopping in-store because they worry that prices will be higher than online shopping. To reiterate consumer pricing concerns further, 38% of consumers also admit they are discouraged by the inability to search for cheaper deals in physical stores, compared to the ease of doing so online.

9. Marketplaces are an emerging shopping channel

Aside from online and in-store, our data points towards an emerging channel for retailers to consider in 2024: marketplaces.

Nearly one-third of shoppers regularly shop on marketplaces like Amazon, eBay and Facebook. However, if you look at generational differences in marketplace shopping, there’s a distinct difference, yet again, between age groups. Our data shows that nearly three times as many Millenials (19%) shop on marketplaces compared to Gen Z (7%).

10. Special deals are crucial for encouraging local shopping

As we touched on earlier, price plays an influential role in consumer purchasing decisions. Unsurprisingly, our data found that the most crucial thing shoppers want when shopping locally is exclusive access to special deals for locals.

With over one-third of customers agreeing, it’s clear that providing customised offers for loyal local shoppers will play a key role in encouraging repeat business.

11. Personalisation is important in local retail

While personalisation isn’t a new concept, our data points towards a growing number of shoppers who prefer a tailored, personalised retail experience.

One in four shoppers express a desire for personalised shopping experiences, highlighting the importance of incorporating personalisation into a retail marketing strategy, ensuring personalised touchpoints throughout the customer journey.

12. Returns policy influences purchase decisions

Our report shows that inflexible or expensive returns policies can deter customers from shopping, with over half considering free returns as standard practice for in-store shopping.

As a result, an inflexible return policy deters 37% of consumers from shopping in-store. Again, gender plays an interesting role in this finding, with more females (59%) than males (46%) emphasising the importance of in-store return policies.

Prepare for the future of retail

In the ever-evolving landscape of Australian retail, consumer preferences will significantly shape the shopping experience in 2024. From the resilience of physical stores to Gen Z’s surprising online shopping habits, our data provides a strong foundation for navigating the ever-changing landscape of consumer behaviour.

As we dive into the year ahead, retailers can use these insights to craft strategies that embrace omnichannel retail, harness the power of loyalty programs, and seamlessly blend physical and digital stores to create a unified shopping experience.

Prepare your retail store for the year ahead

Download our free guide that reveals customers' shopping preferences and habits and shares actionable insights for retailers in 2024.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.